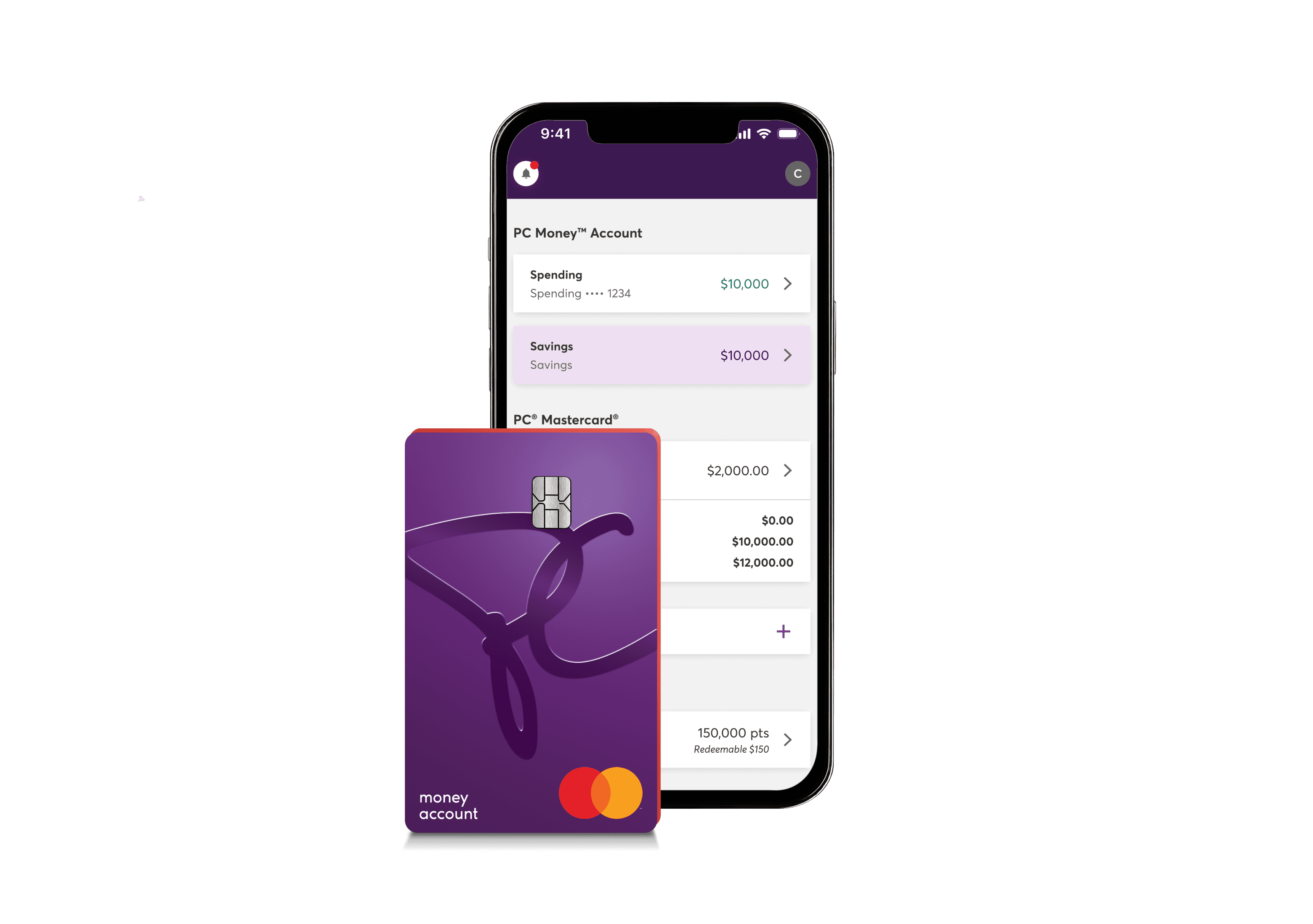

PC MoneyTM Account

* interest on your savings. No catches.

- No monthly fee

- No time commitment

- No minimum balance

Welcome offer

You get $100 in PC OptimumTM points offer** when you open an account.

That’s like $100!

Spend for PC OptimumTM points.

Save with high interest.

President’s Choice Bank is a member of the Canada Deposit Insurance Corporation (CDIC).

Winner of the Best Rewards Bank Account for 2025 by MoneySense7

Join thousands of customers

earning over $700 in value every year.^

Bank with confidence

Multi-factor authentication

An added layer of security.Card lock ability

In case of a lost or stolen card.Security notifications

So you’re informed on account activities.Mastercard® Zero Liability Promise8

For unauthorized purchases.

FAQs

What is the PC Money™ Account?

PC Money™ Account is the only no monthly fee bank account that rewards you with PC Optimum™ points for your everyday banking and spending, and lets you earn interest on your savings balance.You can use your PC Money™ Account for all your banking activities like making everyday purchases, ATM withdrawals, bill payments, Interac e-transfer services, setting up pre-authorized payments and debits and for receiving your payroll or pension direct deposits.The PC Money™ Account also comes with an optional savings feature that allows you to earn interest on your savings balance. This feature is available to both existing and new customers.

How do I open a PC Money™ Account?

Applying for a PC Money™ Account is quick and easy. All you need to do is complete this application.What you need to know to get started

- Be a resident of Canada: The PC Money™ Account is only available to residents of Canada.

- You'll need to be a minimum of 16 years old at the time of your application

- Have your SIN ready: This is required if you add the savings feature to your PC Money™ Account.

- You’ll also require information about your occupation or employment status

How is PC Money™ Account different from other bank accounts?

The PC Money™ Account is the only bank account that offers you two different ways to get more from your money. Earn PC Optimum™ points on your everyday banking and spending transactions, while also earning interest on your savings balance. With just one account, you get the best of both worlds. You can also use your card everywhere Mastercard® is accepted, including online and when travelling abroad. However, you can’t write or deposit cheques, or use your card with merchants that don’t accept Mastercard® payments.

What is the new savings feature?

It is a new optional feature that is available with the PC Money™ Account, that helps you grow your savings by earning interest on every dollar you save. You can add it to your account during your application as a new customer, or through your PC Financial® app or online account as an existing customer. With the savings feature added to your PC Money™ Account, you now earn interest while you save and you still earn PC Optimum™ points when you spend. So, whether you bank or save, it’s a win-win!

What is the interest rate on Savings?

We start with our best everyday interest rate You’ll earn our competitive everyday interest rate with the PC Money™ Account Savings feature. This rate is designed to help you grow your savings steadily over time. While we remain committed to providing you with our best possible rate, we review our rate regularly and adjust it based on changes to the Bank of Canada’s rate. As a result, it may change from time to time. Get the bonus interest rate to grow your Saving faster If you qualify for the bonus interest rate, an additional 0.7%* will be added on top of your everyday rate during the offer benefit period. How to calculate your interest

For example, with a 2.2% interest rate, a $10,000 deposit will earn you $220 in one year. Since interest is calculated daily and paid monthly on your Savings balance, you will receive $18.33 monthly. To review the latest rates available, visit pcfinancial.ca

For example, with a 2.2% interest rate, a $10,000 deposit will earn you $220 in one year. Since interest is calculated daily and paid monthly on your Savings balance, you will receive $18.33 monthly. To review the latest rates available, visit pcfinancial.ca