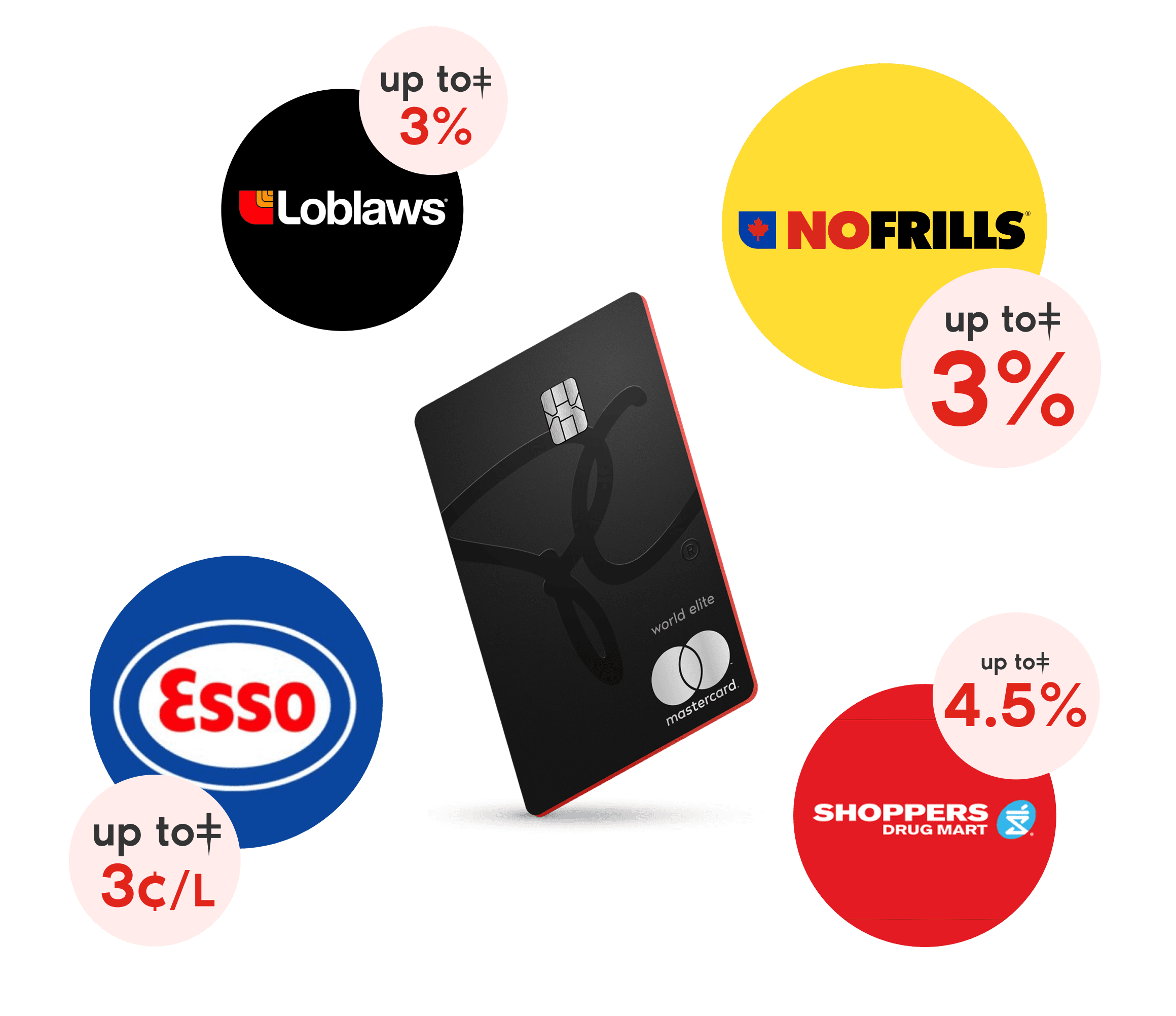

Up to 4.5% back in PC® Optimum™ Points on every swipe

No annual fees and at least 1% back in PC® Optimum™ points everywhere with every swipe.

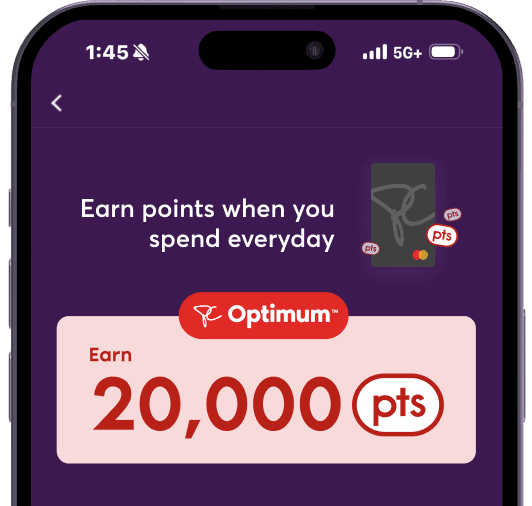

Enjoy 20,000 bonus PC Optimum™ points**

Make the most from your award-winning§ credit card

No annual fee

Free additional cardholders

$0

Purchase interest rate (standard)7

21.99%

Cash advance interest rate (standard)7

22.97%

21.97% (Quebec)

One application matches you with the right no annual fee PC® Mastercard® based on your eligibility

Eligibility

Subject to credit approval and other eligibility criteria.

You can earn:

- 1% back in points* at our grocery stores1

- At least 3¢ / litre back in points at Esso™ and Mobil™ stations in Canada3

- 2.5% back in points at Shoppers Drug Mart® and Pharmaprix®2

- 1% back in points at Joe Fresh®*

- 1% back in points on dining, transit, and everywhere else*

Core benefits

- Mastercard Global ServiceTM4

- Purchase Assurance5

- Extended Warranty5

- Redeem PC OptimumTM points instantly in-stores and in-app to pay down your balance9

Eligibility

Subject to credit approval and other eligibility criteria.

You can earn:

- 1% back in points* at our grocery stores1

- At least 3¢ / litre back in points at Esso™ and Mobil™ stations in Canada3

- 2.5% back in points at Shoppers Drug Mart® and Pharmaprix®2

- 1% back in points at Joe Fresh®*

- 1% back in points on dining, transit, and everywhere else*

Core benefits

- Mastercard Global ServiceTM4

- Purchase Assurance5

- Extended Warranty5

- Redeem PC OptimumTM points instantly in-stores and in-app to pay down your balance9

Eligibility

Minimum $50,000 (personal) or $80,000 (household) annual income required. Subject to credit approval and other eligibility criteria.

You can earn:

- 2% back in points* at our grocery stores1

- At least 3¢ / litre back in points at Esso™ and Mobil™ stations in Canada3

- 3.5% back in points at Shoppers Drug Mart® and Pharmaprix®2

- 2% back in points at Joe Fresh®*

- 1% back in points on dining, transit, and everywhere else*

Core benefits

- Mastercard Global ServiceTM4

- Purchase Assurance5

- Extended Warranty5

- Redeem PC OptimumTM points instantly in-stores and in-app to pay down your balance9

Additional benefits

Concierge Services6

Concierge Services6

Eligibility

Minimum $80,000 (personal) or $150,000 (household) annual income required. Subject to credit approval and other eligibility criteria.

You can earn:

- 3% back* in points at our grocery stores1

- At least 3¢ / litre back in points at Esso™ and Mobil™ stations in Canada3

- 4.5% back in points at Shoppers Drug Mart® and Pharmaprix®2

- 3% back in points at Joe Fresh®*

- 1% back in points on dining, transit, and everywhere else*

Core benefits

- Mastercard Global ServiceTM4

- Purchase Assurance5

- Extended Warranty5

- Redeem PC OptimumTM points instantly in-stores and in-app to pay down your balance9

But wait, there's more benefits

Concierge Services6

Concierge Services6 Travel Emergency Medical Insurance6

Travel Emergency Medical Insurance6 Car Rental Collision/Loss Damage Waiver Insurance6

Car Rental Collision/Loss Damage Waiver Insurance6 Identity Theft Assistance Service6

Identity Theft Assistance Service6

Like cashback, without the catches

Earn points everywhere you shop.

Earn PC Optimum™ points on every dollar you spend; that’s at least 1% back in points* including dining, gym memberships, subscriptions, and everything else you purchase.

Unlimited points that don't expire.

Good news! Your PC Optimum™ points don’t expire, and there are no limits on how many points you can earn. So, you can keep earning on everything you buy, whenever you want — with no catches.

Earn up to $750 every year.†

From grocery, fuel, and beauty to everyday purchases, you’ll get valuable rewards whenever and wherever you use your card.

Convenient rewards on your terms.

Turn your PC Optimum™ points into instant savings. Redeem your points anytime at over 4,500 locations across Canada or towards paying down your PC Financial® credit card balance.

Insurance coverage available for your PC® Mastercard®

Frequently asked questions

What is the PC Financial® Mastercard®?

A PC® Mastercard® is a credit card issued by President's Choice Bank. It allows you to make purchases conveniently and securely, both online and in-store, while earning valuable PC Optimum™ points on everyday spending with no caps for earning points. Points can be redeemed at participating locations or participating websites3.

What are the differences between the three No Annual Fee PC® Mastercard® credit cards?

President's Choice Financial offers a range of no annual fee credit cards that offer value for everyday spending with no limits on points earning. Here's a quick look at each credit card:

PC® Mastercard®: The no annual fee card that rewards you 1% back in points when you shop2 and 2.5% back in points at Shoppers Drug Mart® stores5.

PC® World Mastercard®: Offers no annual fee, 3.5% back in points at Shoppers Drug Mart® stores5 and 2% back in points2 at participating grocery stores3.

PC® World Elite® Mastercard®: Offers no annual fee, 4.5% back in points at Shoppers Drug Mart® stores5 and 3% back in points2 at participating grocery stores3.

Plus, earn at least 3¢ / litre back in points on gas at Esso™ and Mobil™ stations in Canada4.

Note: Your application for a no annual fee PC® Mastercard® will be evaluated to determine the most suitable card for you.