The NEW PC Insiders™ World Elite Mastercard®: Experience Extraordinary Value, Everyday

Introducing the PC Insiders™ World Elite Mastercard®, our most rewarding credit card ever. Step into a new era of value and convenience with a credit card that is designed to elevate your shopping experience and give you more points, more perks, and more PC®! Created for Loblaw brand enthusiasts looking to get more value from their everyday purchases, the card offers the highest PC Optimum™ points earn-rate across everyday essentials, including grocery, gas and beauty.

More Points

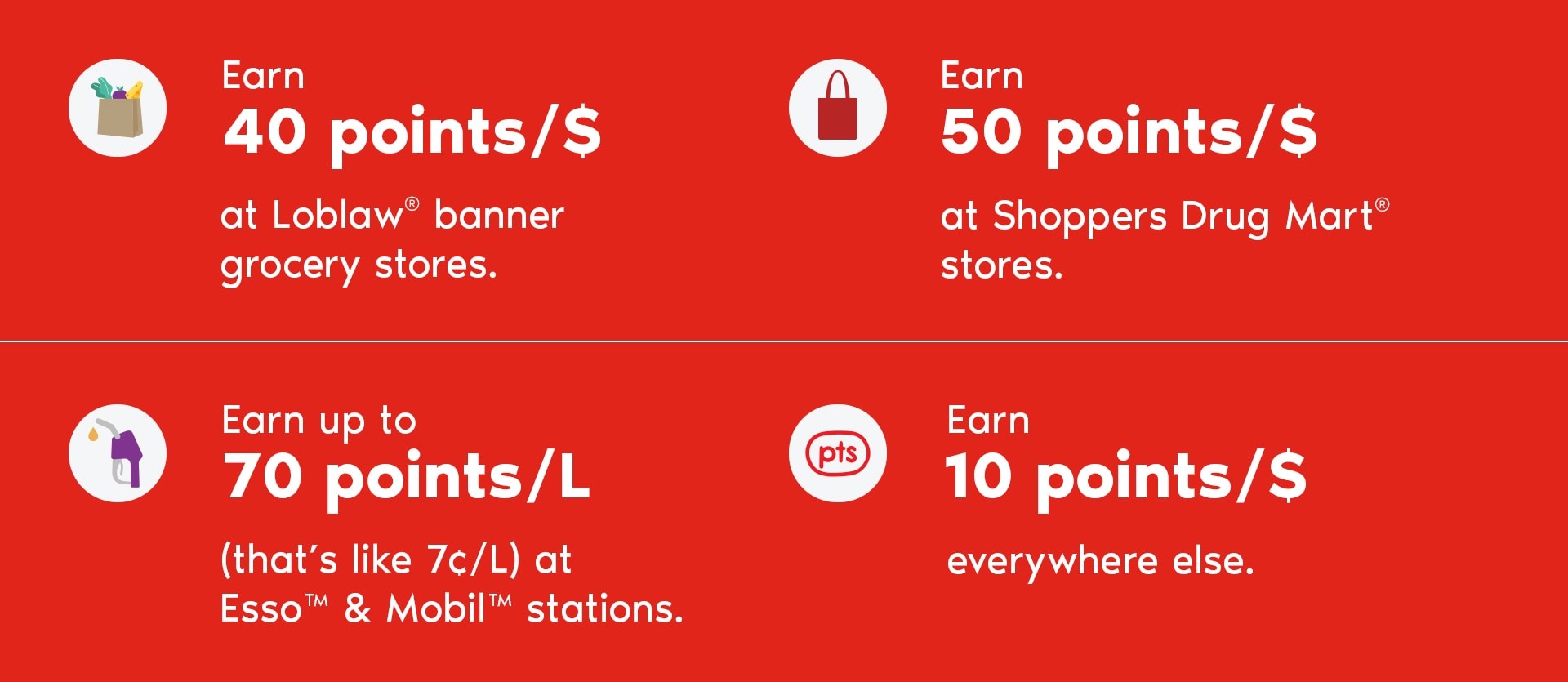

Delve into the incredible value this card has to offer. This latest addition to the PC® Mastercard® roster is crafted to help get you more back from every dollar you spend at participating locations.

PC Insiders™ World Elite Mastercard® cardholders can:

More Perks

This new credit card offers unlimited points earning potential on everyday essentials like grocery, beauty, and gas; meaning cardholders can get $1,100 in average annual value1. Additionally, the flexibility to add up to 4 additional cardholders at no extra cost allows for pooling of points, accelerating your journey to earn more rewards even faster.

The NEW PC Insiders™ World Elite Mastercard® also comes with Mastercard® World Elite benefits like:

Purchase Assurance

Extended Warranty

Mastercard Global Service™

Concierge Services

Travel Emergency Medical Insurance

Car Rental Collision/Loss Damage Waiver Insurance

Identity Theft Assistance Service

Conditions apply to all benefits. Full details (opens in a new window).

More PC®

Picture this: your kids come home from school, and you find out they have a bake sale tomorrow. Stepping out to do groceries at this hour can seem a bit overwhelming. But worry not, because this is precisely where PC Express™ steps in – with unlimited $0 online grocery delivery and pickup, those cookies are ready to go!

The PC Insiders™ World Elite Mastercard® offers a gateway to an elevated shopping experience all for an annual fee of $1202. The array of exclusive benefits and rewards it unlocks, makes it a worthwhile choice for those seeking unparalleled value.

If you already have a PC® World Elite Mastercard®, here's some exciting news – you’re auto-approved for an upgrade3 to the PC Insiders™ World Elite Mastercard®, with no credit check required. Have a PC® Mastercard® or PC® World Mastercard®? Check your PC Financial® account (opens in a new window) to see if you’re eligible to upgrade.

So, if you enjoy getting the most value out of everyday purchases, then you’ll love the NEW PC Insiders™ World Elite Mastercard®, no matter how or where you shop. Unlock a full spectrum of benefits when you apply for the credit card (opens in a new window) that redefines extraordinary value, everyday!

General information not about PC Financial® products is provided for your reference and interest only. The above content is intended only to provide a summary and general overview on matters of interest and is not a substitute for and should not be construed as the advice of an experienced professional. PC Financial® does not guarantee the currency, accuracy, applicability, or completeness of this content.

¹Average annual value estimate consists of PC Express™ Pass annual subscription ($99.99) plus PC Optimum™ points predicted to be earned annually by average active PC Insiders™ World Elite Mastercard® cardholders. Total and category spending estimates are based on 2022 annual purchase data from PC Financial® World Elite Mastercard® cardholders projected to upgrade to PC Insiders™ World Elite Mastercard®. For illustrative purposes only; results vary based on individual spending.

²PC Insiders™ World Elite Mastercard® has an annual fee of $120. Each account statement normally covers between 28 and 33 days. There is an interest-free grace period of a minimum of 21 days for new purchases (meaning purchases which have not appeared on any previous statement) if you pay your entire current statement balance in full by the applicable due date, otherwise interest is charged from the transaction date. The interest-free grace period does not apply to Cash Advances (which include balance transfers and convenience cheques), and interest is charged from the transaction date. The minimum payment per account statement is any past due amounts, plus: your statement balance if $10 or less, or the greater of (a) $10, (b) 2.2% of your total statement balance (5% for new accounts issued to Quebec residents since August 1, 2019, and for all other accounts held by Quebec residents: 3% effective August 1, 2021, 3.5% effective on August 1, 2022, 4% effective August 1, 2023, 4.5% effective on August 1, 2024, and 5% effective on August 1, 2025), or (c) the interest charges and fees billed on the current statement plus $1. Standard Annual Purchase Interest Rate of 21.99% or Basic Annual Purchase Interest Rate of 26.99% (not available in Quebec) applies to all purchases and to any fee, charge or markup treated as a purchase according to your Cardholder Agreement. Standard Annual Cash Advance Interest Rate of 22.97% (in Quebec, 21.97%) or Basic Cash Advance Interest Rate of 27.97% (not available in Quebec) applies to all cash advances, non-promotional balance transfers, and any other transaction, fee or charge treated as a cash advance according to your Cardholder Agreement. Based on your account use (including if you exceeded your credit limit or had any dishonoured payments), or your credit bureau reports and credit history, we may, upon providing the required notice, increase the above rates of interest to the Annual Performance Interest Rate of 26.99% for Purchases and 27.95% for Cash Advances. The Annual Default Interest Rate of 26.99% for Purchases and 27.97% for Cash Advances will apply to your entire unpaid balance if you do not make your minimum monthly payment by the due date for two consecutive months, or if you are not in full compliance with the terms of your Cardholder Agreement. For foreign currency transactions, the foreign currency conversion markup percentage charged for purchases and cash advances and deducted from refunds and credits is 2.5% of the amount of the charge or credit transaction. Other fees are: cash advance at a bank machine or teller in Canada: $5; cash advance outside Canada: $7.50; overlimit charge if over the credit limit on statement date: $29 (for Quebec residents: $0); cash equivalent transaction (such as for a wire transfer or money order): 1% (minimum $5, maximum $10); dishonoured payment or convenience cheque: $42; copy of a sales draft: $10 (for Quebec residents: $0); copy of a previous account statement: $10; credit balance refund made by cheque: $20; balance transfer fee of 1% of the transferred amount (up to 5% of the transferred amount effective July 28, 2023). The exact fee will be disclosed to you before the transfer is submitted and is charged when the transfer posts to your account); inactive account: if on your statement date there is a credit balance on your account and there has been no activity on your account (meaning no debits, credits, interest or fees) for the preceding 12 consecutive months, your account is subject to a fee equal to the lesser of $10 or the credit balance amount. Subject to change.

³Upgrade offer is based on your current President’s Choice Financial® Mastercard® account status and details. Offer subject to change, extension or cancellation without notice.