Credit Card 101: The Ultimate Guide

.jpg)

You probably carry one everywhere you go, and use it to buy almost anything, from impulse buys to planned purchases, but how much do you really know about your credit card?

Welcome to your go-to handbook for navigating credit cards and everything to do with them. If you’ve got questions about credit cards and how you can make the most of it, you're in the right spot.

So, let’s dive in!

What is a Credit Card?

A credit card is a convenient financial tool that lets you borrow money for a little while, making it easy to buy stuff and pay for services. It can be either a physical or digital card and is used to access your credit card account.

How credit cards work:

You make everyday purchases with a credit card.

Monthly, you receive a statement (but we’ll dive into that in a moment) that is a record of your purchases and shows how much you owe.

Every credit card has a credit limit. If you're new to credit, you might start with a lower limit, which can increase over time based on your income and credit history. Factors like credit score, total income, expenses, current debt, credit card applications, and employment status influence this credit limit. To begin building a robust credit score, make at least the minimum credit card payments—the lowest monthly amount you can pay to avoid accruing interest.

If you pay back the whole amount by the due date, then you won’t be charged any interest (i.e. the cost of borrowing money—a small extra fee that you incur if you don't pay back the full amount you owe by the due date; more on that below). If you only make the minimum payment, you will be charged interest on the remaining amount.

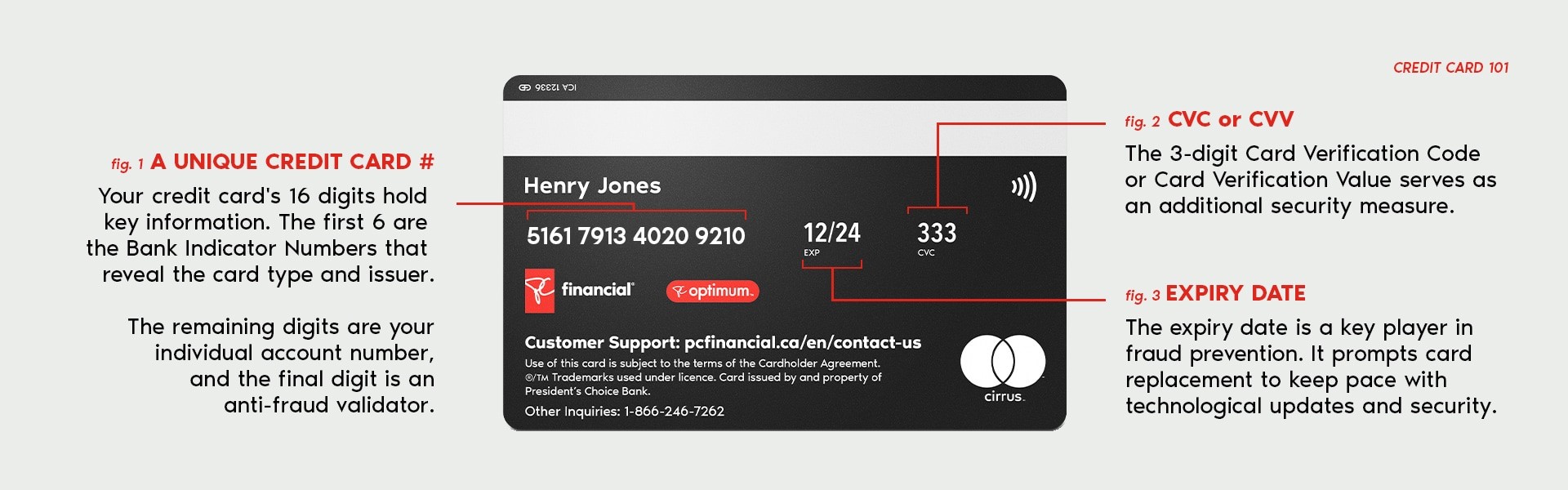

A credit card contains some important pieces of information like:

What is a Good Credit Score?

First, a credit score is a three-digit number that represents how likely you are to repay money loaned to you, based on your financial history. This score can range anywhere between 300 and 900—the higher the number, the stronger your credit standing.

A good credit score means you are considered a low-risk borrower by lenders because of your positive credit history. With a good credit score, you are more likely to qualify for loans, credit cards, lower interest rates and better loan terms. For instance, when you want to rent an apartment or make a major purchase down the road, a good credit report will help your application.

If you can’t pay the whole balance, making the minimum payment will help keep your hard-earned score intact. Here are a few other things that can help boost your credit score over time:

Timely Payments: Show reliability by paying bills on time, building a positive credit history.

Low Balances: Keep credit card balances under 30% of the limit. When possible, pay off as much as possible each billing period to steer clear of the limit.

Long-Term Commitment: Stick with a chosen credit card for the long haul. Consistent payments over time can help build a better credit score.

What Credit Card Is Right For You?

Finding the right credit card is not just about making payments, it's also an incredible opportunity to make your money work smarter for you. A key to this is selecting a rewards credit card that aligns with your spending habits. PC Financial® Mastercard® credit cards (opens in a new window) for example, let you earn PC Optimum™ points on every dollar you spend to redeem towards free groceries, health and beauty supplies at participating stores1, and on gas and car wash rewards at Esso™ stations2, and much more!

Based on the wide range of options available, you could be directed to one of the following types of credit cards:

No Annual Fee Credit Cards: These cards do not charge an annual or monthly fee for usage, which means you can build and maintain your credit score without worrying about an extra yearly cost. They're not just cost effective, but also come with a bunch of various benefits and rewards. The PC® Mastercard® (opens in a new window) is a great example of a no annual fee* card that earns you rewards – the best of both worlds!

Annual Fee Credit Cards: These credit cards carry an annual or monthly fee you pay to gain access to more perks, exclusive features, and overall value. The NEW PC Insiders™ World Elite Mastercard® (opens in a new window) is one such annual fee* card that offers the highest PC Optimum™ points earn rates on your everyday purchases like groceries, health, and beauty at participating stores3, and fuel at Esso™ and Mobil™ stations4, plus perks like a complimentary PC Express™ pass ($99.99 value per year)5, and more.

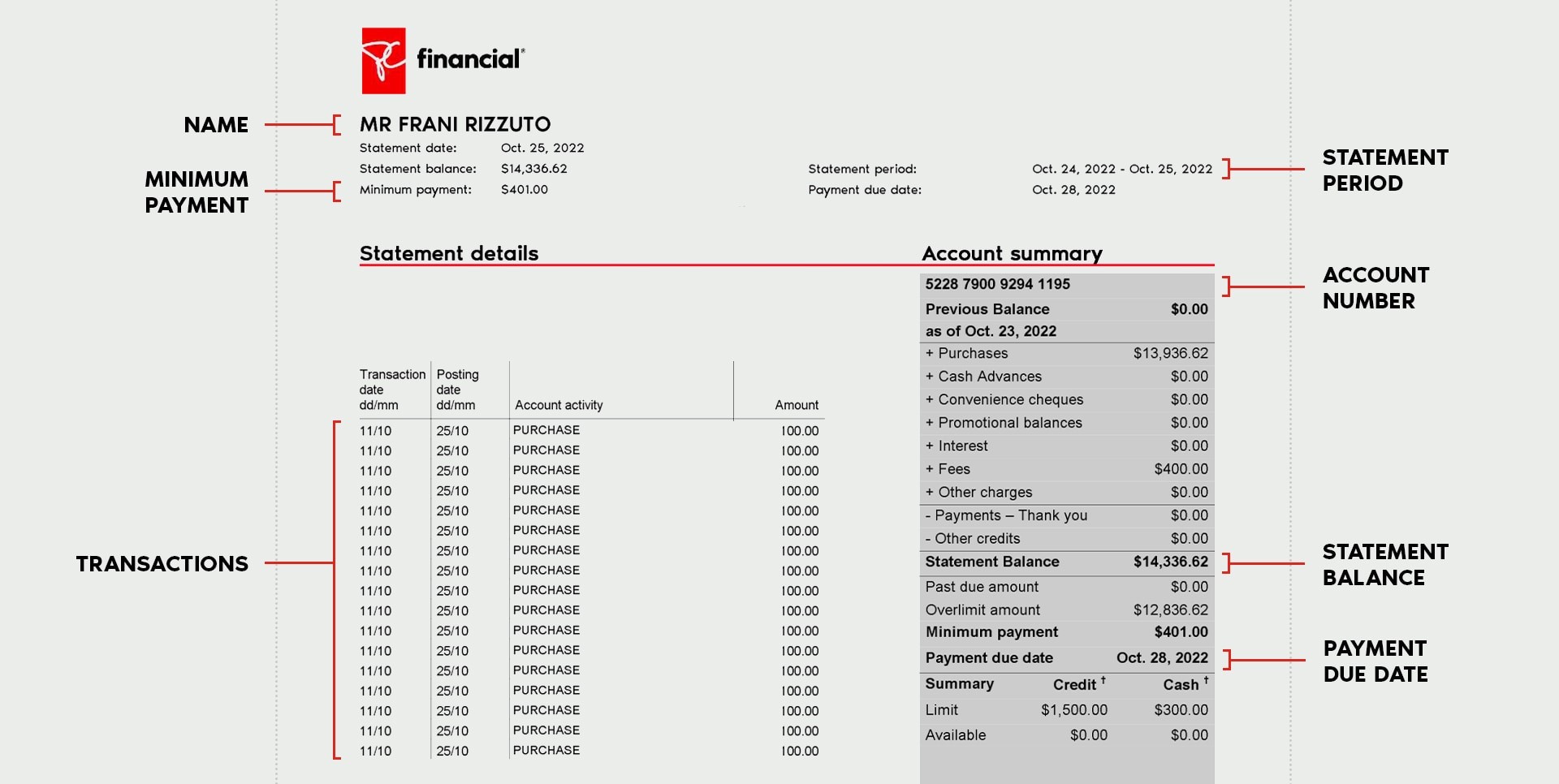

Understanding a Credit Card Statement

A credit card statement is an overview of how much money you currently owe, typically issued monthly. It includes all your credit card activity like purchases, rewards that you may have earned, interest accrued, and fees for that billing cycle. If you’re already a PC Financial® credit card holder, you can log in to access your statements from your account.

Minimum Payment: Pay either the total amount due or the minimum payment by the due date. If the full balance isn’t paid within the grace period, interest rates apply to the unpaid portion.

Transactions: Review your statement carefully and immediately report any errors or potential fraud.

Statement Period: The billing period or the days covered by your statement.

Statement Balance: The total amount of your purchases, cash advances, interest, and fees.

Payment Due Date: There is a grace period (minimum 21 days in Canada) to clear outstanding balances.

Additionally, it's crucial to be aware of credit card interest rates, as they vary among different card providers and are subject to changes influenced by government policies and economic conditions.

The credit card provider should give you all the important documents for your credit card account, such as a Cardholder Agreement, which describes in detail the terms and conditions associated with using the account. You can view the President’s Choice Financial® Mastercard® Cardholder Agreement here (opens in a new window) and the PC Insiders™ World Elite Mastercard® Cardholder Agreement here (opens in a new window) for more information.

How to Apply for a Credit Card?

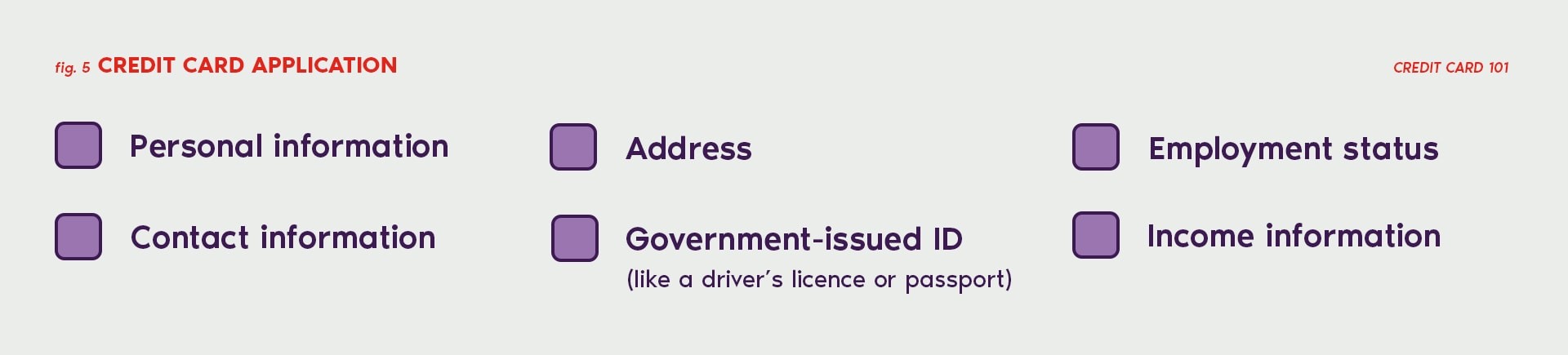

Now that you understand the basics, let's explore how to apply for a credit card. Different cards have varied qualifications.

Applying for a Canadian credit card is usually straightforward and can often be done online. To do so, you'll typically need:

You can also take a look at this guide to help you get started (opens in a new window) with your PC® Mastercard® application.

Once submitted, your credit score, income, and repayment history are considered for approval, credit limit, and potential interest rates. While credit card approval times may differ, most decisions come within a few days, but your bank may reach out for additional information if needed.

Having explored the ins and outs of credit cards, you’re now ready to tackle them confidently, feeling more assured in your ability to understand and use them effectively.

So, if you’re looking to unlock rewards while building credit, let us help you start your next chapter of financial growth on the right foot! While you’re at it, why don’t you start by checking out our PC Financial® (opens in a new window) cards to find one that fits your life perfectly.

General information not about PC Financial® products is provided for your reference and interest only. The above content is intended only to provide a summary and general overview on matters of interest and is not a substitute for and should not be construed as the advice of an experienced professional. PC Financial® does not guarantee the currency, accuracy, applicability, or completeness of this content.

PC Insiders™ World Elite Mastercard® has an annual fee of $120. All other PC Financial® Mastercard® credit cards: no annual fee. Each account statement normally covers between 28 and 33 days. There is an interest-free grace period of a minimum of 21 days for new purchases (meaning purchases which have not appeared on any previous statement) if you pay your entire current statement balance in full by the applicable due date, otherwise interest is charged from the transaction date. The interest-free grace period does not apply to Cash Advances (which include balance transfers and convenience cheques), and interest is charged from the transaction date. The minimum payment per account statement is any past due amounts, plus: your statement balance if $10 or less, or the greater of (a) $10, (b) 2.2% of your total statement balance (5% for new accounts issued to Quebec residents since August 1, 2019, and for all other accounts held by Quebec residents: 3% effective August 1, 2021, 3.5% effective on August 1, 2022, 4% effective August 1, 2023, 4.5% effective on August 1, 2024, and 5% effective on August 1, 2025), or (c) the interest charges and fees billed on the current statement plus $1. Standard Annual Purchase Interest Rate of 21.99% or Basic Annual Purchase Interest Rate of 26.99% (not available in Quebec) applies to all purchases and to any fee, charge or markup treated as a purchase according to your Cardholder Agreement. Standard Annual Cash Advance Interest Rate of 22.97% (in Quebec, 21.97%) or Basic Cash Advance Interest Rate of 27.97% (not available in Quebec) applies to all cash advances, non-promotional balance transfers, and any other transaction, fee or charge treated as a cash advance according to your Cardholder Agreement. Based on your account use (including if you exceeded your credit limit or had any dishonoured payments), or your credit bureau reports and credit history, we may, upon providing the required notice, increase the above rates of interest to the Annual Performance Interest Rate of 26.99% for Purchases and 27.95% for Cash Advances. The Annual Default Interest Rate of 26.99% for Purchases and 27.97% for Cash Advances will apply to your entire unpaid balance if you do not make your minimum monthly payment by the due date for two consecutive months, or if you are not in full compliance with the terms of your Cardholder Agreement. For foreign currency transactions, the foreign currency conversion markup percentage charged for purchases and cash advances and deducted from refunds and credits is 2.5% of the amount of the charge or credit transaction. Other fees are: cash advance at a bank machine or teller in Canada: $3.50; cash advance outside Canada: $7.50; overlimit charge if over the credit limit on statement date: $29 (for Quebec residents: $0); cash equivalent transaction (such as for a wire transfer or money order): 1% (minimum $5, maximum $10); dishonoured payment or convenience cheque: $42; copy of a sales draft: $10 (for Quebec residents: $0); copy of a previous account statement: $10; credit balance refund made by cheque: $20; balance transfer fee of 1% of the transferred amount: up to 5% of the transferred amount. The exact fee will be disclosed to you before the transfer is submitted and is charged when the transfer posts to your account); inactive account: if on your statement date there is a credit balance on your account and there has been no activity on your account (meaning no debits, credits, interest or fees) for the preceding 12 consecutive months, your account is subject to a fee equal to the lesser of $10 or the credit balance amount. Subject to change.

¹1Minimum redemption is 10,000 PC Optimum™ points (worth $10 in rewards) and in increments of 10,000 PC Optimum™ points thereafter at participating stores where President's Choice® products are sold. Some redemption restrictions apply. Visit pcoptimum.ca for details, participating stores and full loyalty terms and conditions.

²Limited to one redemption per day at Esso™ stations. 10 cents off per litre fuel redemption option valid at Esso™ stations across Canada. Car wash redemption option available at participating Esso™ stations with car wash facilities where advertised. Only redeemable at points level specified in a single transaction. 10 cents off per litre valid on actual number of litres fueled, to a maximum of 40 litres per redemption transaction, or a single car wash depending on the redemption option selected. Limit of one redemption per PC Optimum™ account per calendar day at participating Esso™ stations (in accordance with President’s Choice Services Inc.’s official records). A valid PC Optimum™ card, PC Money™ Account card or President’s Choice Financial® Mastercard® must be swiped at the pump or a valid PC Optimum™ card, PC Optimum™ app, PC Money™ Account card or PC Financial® Mastercard® must be scanned or swiped in the station as part of the payment transaction in order for PC Optimum™ points to be redeemed on fuel or car wash purchases, as applicable. Car wash options available for redemption are subject to availability and do not include coin operated car washes. Car wash codes can only be used at the station where the reward was issued unless otherwise specified in writing at the time of redemption and may be subject to expiration timelines. Redemption not available using manual card number entry, phone number entry, or the Speedpass+ app. For fuel redemption, taxes payable on full purchase price before application of reward. Points are not redeemable for cash or credit. We are not obligated to award or redeem points based on errors or misprints. PC Optimum™ redemption is not available at Mobil™ stations.

³Earn 40 PC Optimum™ points per dollar on qualifying purchases made with a PC Insiders™ World Elite Mastercard® credit card at participating Loblaw banner stores. For these purchases you will earn the regular 10 PC Optimum™ points per dollar plus an extra 30 PC Optimum™ points per dollar charged on your card(s) for a total of 40 PC Optimum™ points per dollar. Any bonus PC Optimum™ points offers available to all PC Financial® Mastercard® customers are calculated based on the regular earnings rate of 10 PC Optimum™ points per dollar spent.

4All PC Insiders™ World Elite Mastercard® cardholders earn the regular earning rate of 50 points per litre at Esso™ and Mobil™ stations in Canada, which includes: the standard 10 points per dollar for all qualifying purchases with the PC Financial® Mastercard®, the 30 PC Optimum™ points per litre of gasoline or diesel fuel when you pay with your PC Insiders™ World Elite Mastercard®, and the 10 PC Optimum™ points per litre available to all PC Optimum™ loyalty members. Should fuel prices fall below $1/L, causing total points per litre awarded to fall below 50 points per litre, points will be topped up to ensure a minimum of 50 points per litre are awarded. In addition to the regular earning rate of at least 50 points per litre, PC Insiders™ World Elite Mastercard® cardholders can also earn 20 bonus points per litre – for a total of 70 points per litre – by purchasing at least 150 litres of fuel at Esso™ and Mobil™ stations in a calendar month. The additional 20 points per litre will apply to all fuel purchases made at Esso™ and Mobil™ stations in the same calendar month in which the 150-litre threshold was achieved. Earn an additional 10 points per litre of premium gasoline (Octane 89, 91, 93, 94) at Esso™ and select Mobil™ Stations. You could earn even more points at Mobil™ stations located adjacent to a Loblaw banner grocery store. Exact earn rate is available at the station. For full details including how points are awarded to your PC Optimum™ account and rounding rules, visit pcfinancial.ca/en/legal-stuff/pc-optimum-mastercard/.

5PC Express™ Pass is a monthly or annual subscription plan that gives you $0 pickup or delivery on same-day or future PC Express™ online grocery orders of $35 or more for the duration of the plan. Annual subscription fee of $99.99, plus applicable taxes is waived for PC Insiders™ World Elite Mastercard® cardholders. Cannot be combined with any other PC Express™ Pass subscription promotional offer. Priority pickup and delivery are available with a PC Express™ Pass for $3. PC Express™ Rapid Delivery is available with a PC Express™ Pass for $3. PC Express™ online grocery orders require a $35 minimum spend (before taxes and fees) in order to receive free same-day or future pickup or delivery. Subscription may be automatically cancelled, and your benefits will end immediately if at any time your PC Insiders™ World Elite Mastercard® account is not in good standing, restricted, closed, or changed to a different President’s Choice Financial® credit card. Visit https://www.pcexpress.ca/pass for details on the program.