Your guide to a fast and easy PC® Mastercard® application

Choosing a credit card (opens in a new window) is an important step in your financial future. Not only does having a credit card help you build your credit history, it also gives you the freedom to buy now and pay later. You may have heard about the PC® Mastercard® which has no annual fee, no caps on points earning, and rewards you with PC Optimum™ points on every dollar you spend, everywhere you shop¹. When you’re ready to apply, follow this guide to make your application process fast and easy. Did you know you can apply for a PC® Mastercard® in about the time it takes to make a coffee? Here’s how!

What do I need to apply?

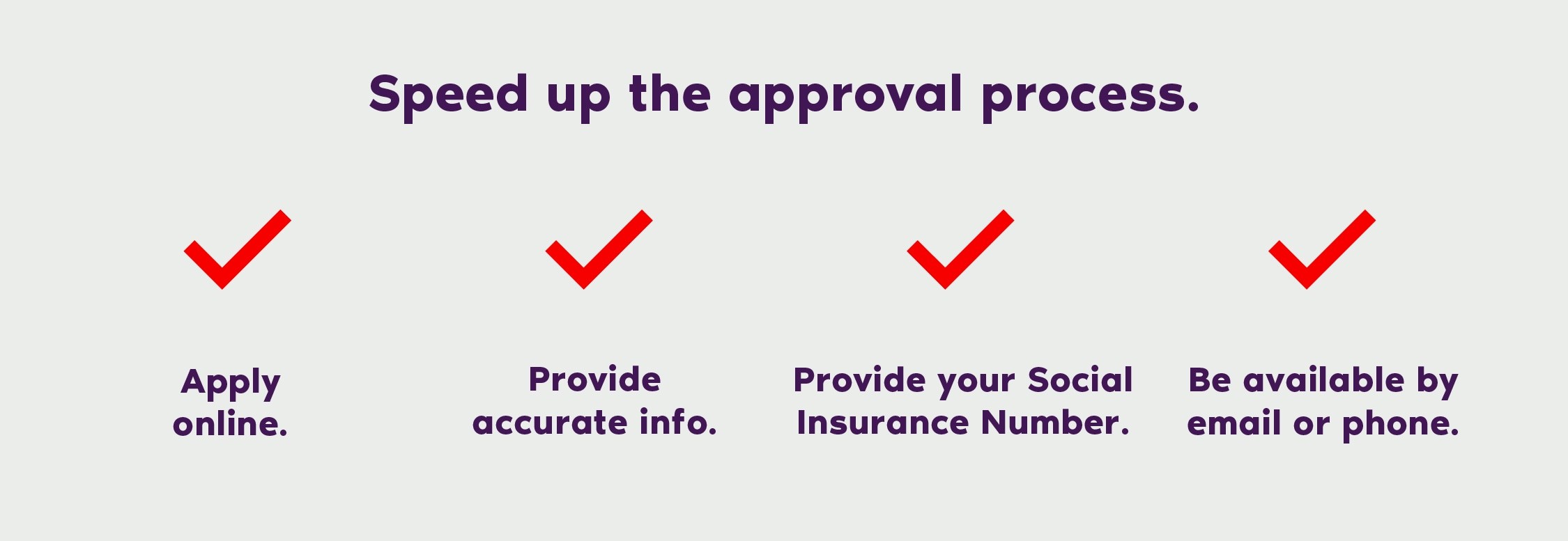

Use this checklist to gather everything you need before visiting the application page. Remember, the more accurate your application information is, the faster your approval process may be. You’ll be asked to provide the following information:

Your full name and date of birth (these need to match your current ID so make sure you’re entering the right information in the right place).

Email, phone number (these must be active in case we need to contact you).

Full street address (not just your RR, P.O. box number, or general delivery).

Social Insurance Number (this is optional, but providing it can speed up your application processing time).

Annual income (not your monthly income).

Employment information (including your status, income, industry, and job title).

Your PC Optimum™ account number – if you’ve got one! This will ensure your accounts are linked (opens in a new window) so you can maximize your points earning potential. If you don’t have a PC Optimum™ account, don’t worry. You can register (opens in a new window) for an account at any time to make sure you’re taking advantage of personalized points offers and bonus points to get to free stuff fast with your PC® Mastercard®.

Opt-in to cardholders insurance.

Cardholder insurance, also known as PSP (Payment Support Plan) (opens in a new window) is optional insurance coverage⁵ that may help with payments on your PC® Mastercard® in case the unexpected happens so that you can focus on what’s important. If it’s appropriate for you, consider opting-in when submitting your application.

Now that you have your info gathered, you’re ready to apply for your PC® Mastercard® online (opens in a new window).

What happens after I apply?

Once you’ve submitted your application, check your email (even the junk/spam folder) and be available to accept calls. If additional information is needed from you, we’ll contact you to let you know. If you don’t hear from us, your application is being processed. If you receive a request for digital ID verification, we’ll ask you for a selfie or a short selfie video and a photo of your ID. You can verify your identity online with any of the following government-issued:

Driver’s license.

Canadian Passport.

Permanent Resident card.

Foreign passports.

Security Certificate of Indian Status (SCIS).

If you receive a request to verify your address, you can provide any of the following:

Utility bill with your name and address.

Bank statement with your name and address.

Canada Revenue Agency (CRA) notice of assessment with your name and address.

Use the most recent proof of address that you have (your documents should not be older than 3 months). The document you provide shouldn’t be redacted or edited and the name and address should match what you provided in your application.

If we have everything we need to proceed, your application should be approved within 7 business days from the date that you submitted it. If you’re approved, you’ll receive a confirmation email and from there, you should get your PC® Mastercard® in the mail within 10-15 business days. Then it’s time for a happy dance! You’re about to earn points on every dollar you spend, everywhere you shop with your new PC® Mastercard®.

What can I do if I didn’t get approved?

If your application is not approved, don’t give up – stay positive. There are steps you can take, like building your credit score. If you’re still learning how, find some tips here (opens in a new window). If a credit card isn’t right for you at this time, that doesn’t mean you have to miss out on PC Optimum™ points! You can earn PC Optimum™ points for your everyday shopping² and banking like paying your bills³ and getting paid⁴ with a PC Money™ Account. Sign up for a PC Money™ Account (opens in a new window) today.

That’s it, you’re all set to apply for your PC® Mastercard® (opens in a new window)!

Don’t forget, if you’re having trouble applying online, you can visit a PC Financial® Pavilion to apply in person. Find one close to you. (opens in a new window)

¹Earn a minimum of 10 PC Optimum™ points per dollar on all of your purchases charged to the credit card. Any bonus PC Optimum™ points offers available to all PC Financial® Mastercard® customers are calculated based on the regular earnings rate of 10 PC Optimum™ points per dollar spent. This offer may be terminated or changed at any time.

²Earn at least 5 PC Optimum™ points per dollar on qualifying purchases with your PC Money™ Account, wherever your card is accepted. Earn 10 PC Optimum™ points (5 regular PC Optimum™ points plus a bonus of 5 PC Optimum™ points) per dollar on qualifying purchases at participating Loblaw banner stores, Shoppers Drug Mart® stores, Joe Fresh® stores, and Esso™ and Mobil™ stations in Canada. Bill payments, electronic funds transfers, account fees and interest are not qualifying purchases for the purpose of earning PC Optimum™ points. PC Optimum™ points will be deducted for any credits or returns. President's Choice Bank reserves the right to cancel, change or extend regular and bonus points earning rates at any time. Account must be in good standing at time of qualifying transaction and awarding of points.

³Earn a bonus of 1,000 PC Optimum™ points for each of up to five bill payments of $50 or more to unique payees, per calendar month, made using a valid PC Money™ Account. Bonus points will be awarded to your PC Optimum™ account within 2-3 weeks of a successful bill payment.

⁴Earn a monthly bonus of up to 5,000 PC Optimum™ points when you deposit funds to your PC Money™ Account using automatic payroll or pension direct deposits. Payroll or pension deposits totaling between $1,500 and $2,999 within a calendar month will earn a bonus of 2,000 PC Optimum™ points, and deposits totaling greater than $2,999 will earn an additional bonus of 3,000 PC Optimum™ points, for a maximum monthly bonus of 5,000 PC Optimum™ points. Limited to one bonus per customer, per month, even if you have multiple PC Money™ Accounts. The classification of a direct deposit as a payroll or pension direct deposit is determined solely by President’s Choice Bank. Interac e-Transfer® services, electronic funds transfers, and other forms of deposits or transfers to your account do not count towards this bonus. Bonus points will be awarded to your PC Optimum™ account within 2-7 business days of when you meet the minimum direct deposit amount(s).

⁵To enrol in Payment Support Plan (PSP) you must be 64 years of age or younger, a Canadian resident and your PC Financial® Mastercard® account must be in good standing. Coverage is not available for residents of Quebec, Saskatchewan and the Yukon Territory. The cost for PSP is 99¢ (plus applicable taxes) per $100 of your current month's statement balance. For example, if the balance on your monthly statement was $300, the cost for that month would be $2.97 plus any applicable taxes. PSP is underwritten by The Canada Life Assurance Company (Canada Life), who can be contacted at 1 877 789 4182.