The new detox: 6 tips towards financial wellness

Welcome to the month of all-encompassing #goals. By now, you’re likely ready to detox from all the resolutions talk and craving a complete cleanse of your newsfeed. But you know what can be more fulfilling than cutting out your holiday chocolate habit or getting 10,000 steps per day? Focusing on your financial wellness, that’s what.

Now is the best time to get organized, set new habits, and start your finances off right with a financial detox. We’ll show you how to get back on track post-holiday indulgence so you can set yourself up for a new year of saving, planning, and points earning (and we won’t make you swear off chocolate). Here’s how you can detox your finances in 2023:

1. Talk more openly about money

Destigmatize money conversations and set the tone for financial wellness by talking openly about money with the important people in your life. Parents: teach your kids about money early and often—the no monthly fee PC Money™ Account (opens in a new window) is a great way for beginner spenders to learn the basics. Students: find a trusted advisor to discuss paying off your student loans. Couples: have a conversation about your short- and long-term financial goals and paying off any debt you may have. It may feel a bit tricky at first but pushing through potentially awkward money talks can be surprisingly rewarding.

2. Earn points on every dollar you spend

This is the year you become a points-earning machine—we can just feel it. Earning PC Optimum™ points on the money you spend—with a PC® Mastercard® and a PC Money™ Account—just makes sense. A PC® Mastercard® can earn you up to 30 PC Optimum™ points¹ for every dollar you spend at participating stores, like No Frills®, Real Canadian Superstore®, Loblaws® and Maxi®, and up to 45 points for every dollar² spent at Shoppers Drug Mart™ and Pharmaprix®. And with a PC Money™ Account, you’ll earn up to 10 points per dollar³ when you shop. Redeeming⁴ all these points on things you need (or a few you really want) is kind of the point.

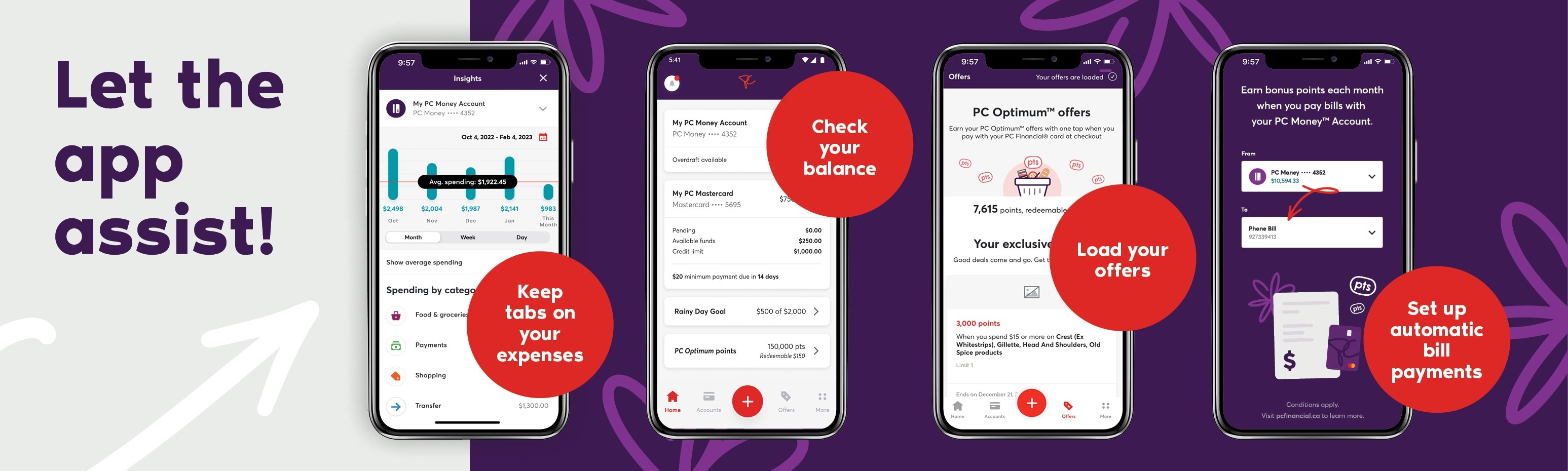

3. Simplify your banking with the PC Financial® app

Simple and efficient — banking (opens in a new window) should be both. So, if you haven’t downloaded the PC Financial® app yet, why not? Use the Insights feature in the PC Financial® app to keep track of your expenses by category and use it to help create your own budget. Check your PC Financial® card and PC Optimum™ points balances, load your PC Optimum™ offers right in the app, and set up automatic bill payments with your PC Money™ Account to put your bills on auto-pilot and earn points for paying them. Did you know you can earn up to 5,000 bonus PC Optimum™ points⁵ with up to five $50+ bill payments every month?

HOT TIP: You can use your PC Money™ Account to pay off your PC® Mastercard® and get rewarded for paying your credit card bills. Like we said: you’re a machine.

4. Build your credit score to make money moves

A healthy credit history will enable you to make more money moves this year—like taking out a loan, increasing your credit limit, or renting a home. Paying your PC® Mastercard® bill on time is one of the keys to building good credit. Find more tips on how to build good credit, including the sweet spot for your credit card balance and the benefits of mixing up your credit products, here (opens in a new window).

5. Trim where you can

One way to save money that doesn’t include cutting the things that bring you joy, like an occasional latte, is giving up monthly and annual banking fees. There’s no monthly fee on the PC Money™ Account, and no annual fee on the PC® Mastercard® — plus you can earn points when you use them. We call that a double shot.

Discover your points earning potential with the PC Money™ Account (opens in a new window).

Discover your points earning potential with the PC® Mastercard® (opens in a new window).

6. Relax, you’ve got this

With these simple financial detox tips, you’re well on your way to financial wellness. Keep up the momentum, collect all the points, and celebrate your wins—especially the small ones. We’ll be over here, cheering you on.

General information not about PC Financial® products is provided for your reference and interest only. The above content is intended only to provide a summary and general overview on matters of interest and is not a substitute for and should not be construed as the advice of an experienced professional. PC Financial® does not guarantee the currency, accuracy, applicability or completeness of this content.

1 Earn a minimum of 10 PC Optimum™ points per dollar on all of your purchases charged to the credit card. Any bonus PC Optimum™ points offers available to all PC Financial® Mastercard® customers are calculated based on the regular earnings rate of 10 PC Optimum™ points per dollar spent. This offer may be terminated or changed at any time.

2 All PC Optimum™ members earn 15 points per dollar on eligible purchases at Shoppers Drug Mart® and Pharmaprix®. When you use your PC Financial® Mastercard® you will earn additional points per dollar: 10 points per dollar for PC Financial® Mastercard® cardholders; 20 points per dollar for PC Financial® World Mastercard® cardholders; and 30 points per dollar for PC Financial® World Elite Mastercard® cardholders.

3 Earn at least 5 PC Optimum™ points per dollar on qualifying purchases with your PC Money™ Account, wherever your card is accepted. Earn 10 PC Optimum™ points (5 regular PC Optimum™ points plus a bonus of 5 PC Optimum™ points) per dollar on qualifying purchases at participating Loblaw banner stores, Shoppers Drug Mart® stores, Joe Fresh® stores, and Esso™ and Mobil™ stations in Canada. Bill payments, electronic funds transfers, account fees and interest are not qualifying purchases for the purpose of earning PC Optimum™ points. PC Optimum™ points will be deducted for any credits or returns. President's Choice Bank reserves the right to cancel, change or extend regular and bonus points earning rates at any time. Account must be in good standing at time of qualifying transaction and awarding of points.

4 Minimum redemption is 10,000 PC Optimum™ points (worth $10 in rewards) and in increments of 10,000 points thereafter at participating stores where President's Choice® products are sold. Some redemption restrictions apply; visit pcoptimum.ca for details, participating stores and full loyalty terms and conditions.

5 Earn a bonus of 1,000 PC Optimum™ points for each of up to five bill payments of $50 or more to unique payees, per calendar month, made using a valid PC Money™ Account. Bonus points will be awarded to your PC Optimum™ account within 2-3 weeks of a successful bill payment.