The 50 30 20 rule and other ways to budget

.jpg)

If you’ve been procrastinating on your budget, there’s no time like right now to get started. Whether you’re a money pro, or just learning the ropes, doing a detox (opens in a new window) of your finances and having an up-to-date budget are two steps you can take towards financial wellness right now.

Not only can a well-thought-out budget help you plan ahead for times of uncertainty, rising inflation (opens in a new window), and emergencies - it can also help you stay focused on your goals while aligning what you’re actually spending with what you think you're spending. If those online shopping and takeout expenses are adding up at the end of the month, this one’s for you. Start planning your budget with these 3 easy steps:

1. Find your after-tax income.

Lay the foundation of your budget by finding the income you actually take home after taxes. If you’re self-employed, a good rule of thumb is allocating 70-75% of your profits as after-tax income, depending on your situation. If you earn a paycheque, look for the total amount deposited into your bank account each month.

Tip: Earn points for getting paid! Set up payroll or pension direct deposit with your no monthly fee PC Money™ Account to earn up to 5,000 PC Optimum™ points (opens in a new window)¹ each month.

2. Track your spending.

Set yourself up for success by tracking your spending to set aside realistic amounts for the future. Otherwise, you might budget $100 for a month of takeout when you’re more likely to spend $200.

Tip: Use the ‘Insights’ feature in your PC Financial® app to see how much you spend per category, then estimate your budget based on your average spend.

3. Stick to it.

Making a budget is great but sticking to it is better. Don’t just set it and forget it. Choose a budgeting style that matches your lifestyle and goals then review it consistently. Plan weekly or monthly check-ins to see how much you actually spent and if it aligns with what you've budgeted, then make adjustments. Finding an accountability partner to check-in with is another great way to stay motivated.

Tip: Look for opportunities to curb your spending and save money in ways that you may not have thought of, like redeeming the PC Optimum™ points you’ve earned with your PC Money™ Account and PC® Mastercard® towards gas rewards², groceries, and other essentials³.

Discover your points earning potential with the PC Money™ Account (opens in a new window).

Discover your points earning potential with the PC® Mastercard® (opens in a new window).

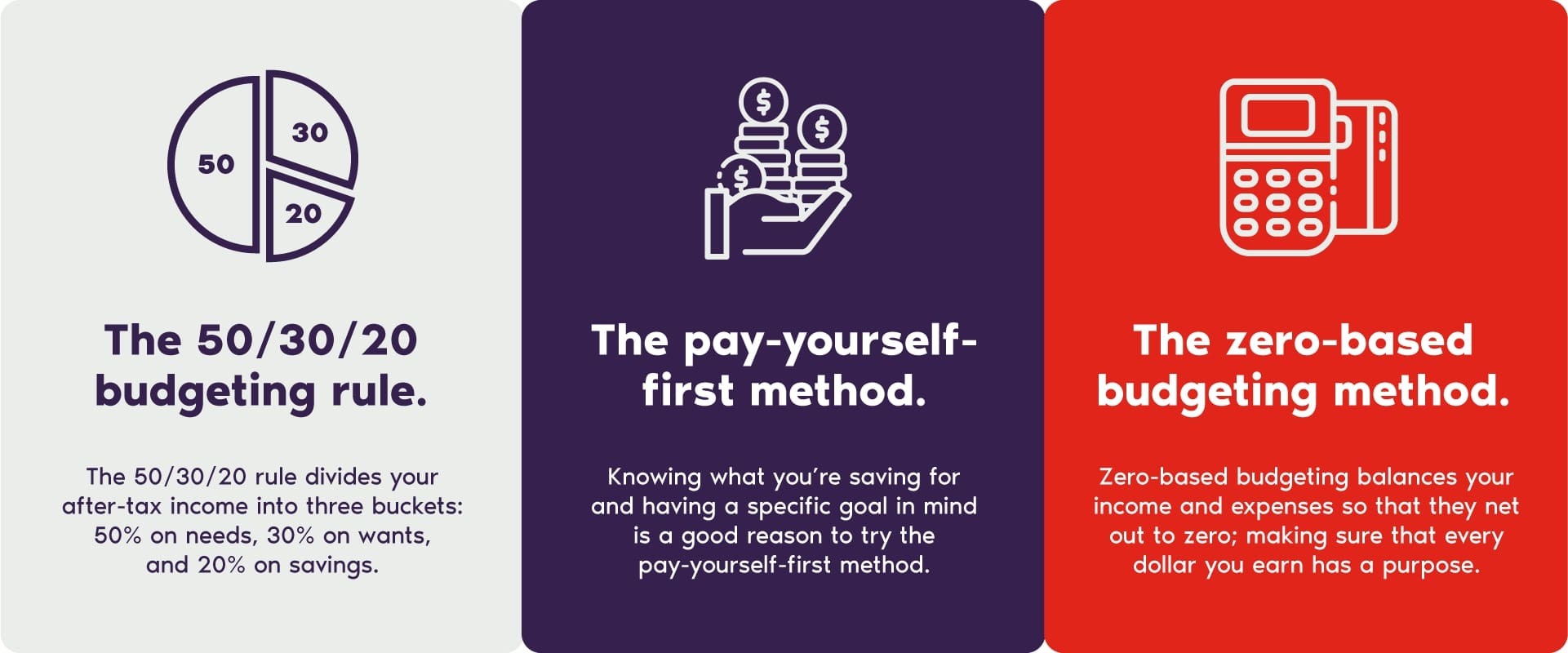

Now it’s time to choose your budgeting style. Three popular methods are the 50 30 20 rule, the pay-yourself-first method, and the zero-based budgeting method. Here’s what you need to know about each style:

Budgeting style #1: The 50 30 20 rule.

The 50 30 20 rule divides your after-tax income into three buckets: 50% on needs, 30% on wants, and 20% on savings. The formula isn’t perfect but it’s a good place to start. Tweak these percentages based on your lifestyle. For example, if you spend more on rent because you live in a big city, then increase your needs budget. The goal isn’t to hit the 50 30 20 ratio perfectly, but to make this style work for you.

Needs can look like:

Rent or mortgage.

Groceries (but not dining out, this is a want).

Hydro and gas.

Minimum debt payments.

Insurance, including home or rental insurance, car insurance, life insurance, etc.

If your needs amount to a lot more than 50% of your income, that’s okay. Having a budget means bringing awareness to where you might want to scale back.

Tip: Not all needs expenses are fixed. Shop around for the best rates on your cellphone, insurance, and other bills. You might want to find a phone plan (opens in a new window) that earns you rewards like PC Optimum™ points. You can also earn up to 5,000 points per month by paying your bills with your PC Money™ Account⁴.

Now it’s time to think about your wants. Wants can look like:

Your morning coffee run.

A night out with friends.

A new wardrobe at Joe Fresh®.

Concert tickets.

Takeout from your favourite restaurant.

Make room in your budget to treat yourself to that new cozy sweater or an oat milk latte. Think of what brings you joy and add it to your wants budget.

Tip: Try using rewards to get more of what you want without paying for it out of pocket. Like earning PC Optimum™ points⁵ for every dollar you spend, everywhere you shop with your PC Money™ Account and PC® Mastercard®. Then, redeeming the points you’ve earned to treat yourself at participating stores.

Now it’s time to think about your savings. Savings can look like:

Paying off high-interest debt.

Starting an emergency fund.

Saving for your wedding.

Planning a vacation.

Saving for your retirement.

Getting ahead on your rent.

Saving for a down payment on your future home.

Tip: Having an emergency fund is an important way to prepare for unexpected expenses that can arise from a job loss, medical or vet bills, or a car or home repair. A good goal to strive for is to set aside 3-6 months of your after-tax income as a safety net. If that feels out of reach, do your best to see how much you can save realistically.

Budgeting style #2: The pay-yourself-first method.

Knowing what you’re saving for and having a specific goal in mind is a good reason to try the pay-yourself-first method. Instead of spending on needs, then wants, then saving whatever’s leftover, the pay-yourself-first method takes a 180-degree shift from this approach. The goal of this style is to build up your habit of saving first.

However, it’s important to know how much you can comfortably save so you don’t end up in overdraft at the end of the month.

Tally up how much you need to spend on your monthly expenses.

Deduct your necessary expenses (like mortgage or rent) from your after-tax income to figure out your discretionary income.

Choose a comfortable amount from your discretionary income to save each month to get closer to your goals.

This budgeting style works well if you have a big goal you’re saving for. Maybe it’s speeding up the purchase of your first home, adding a new member to your family (fur babies count too), or making a big purchase like buying a car. If you’re planning a wedding or a vacation, you might want to try this style.

Budgeting style #3: The zero-based budgeting method.

If you colour code your closet, organize every group outing, and love to plan, plan, plan, you’ll probably find this budgeting style satisfying. Zero-based budgeting balances your income and expenses so that they net out to zero; making sure that every dollar you earn has a purpose.

Take your expenses and subtract them from your after-tax income. If you end up with a negative number, you might be spending more than you make, but don’t panic. Use this as an opportunity to see where you can trim, cut out expenses, and lower where it makes sense to do so. Then try again. Keep trying until you get as close to zero as possible.

If you end up with a surplus, celebrate! Then use it to pay off debt, save for a goal, start an emergency fund, or build more ‘treat yourself’ moments into your budget throughout the year.

Zero-based budgeting can help you gain control over your money and curb impulse spending by figuring out where every dollar goes. It’s also the most time-consuming. If you don’t have time to look through your statements and track every expense and purchase, you might want to try a style you can easily automate like the pay-yourself-first method.

Already have an account? Login here (opens in a new window) to sign-up for e-statements (opens in a new window) and see all of your expenses and purchases while on the go.

When choosing the right budgeting style for you, consider what method boosts your financial confidence, matches your lifestyle, and fits into your routine to up your chances of following through. You can always try different styles, then swap them if they’re not working.

Congratulations on taking a big step towards your financial wellness. Now go forth and budget like you’ve never budgeted before!

General information not about PC Financial® products is provided for your reference and interest only. The above content is intended only to provide a summary and general overview on matters of interest and is not a substitute for and should not be construed as the advice of an experienced professional. PC Financial® does not guarantee the currency, accuracy, applicability or completeness of this content.

1 Earn a monthly bonus of up to 5,000 PC Optimum™ points when you deposit funds to your PC Money™ Account using automatic payroll or pension direct deposits. Payroll or pension deposits totaling between $1,500 and $2,999 within a calendar month will earn a bonus of 2,000 PC Optimum™ points, and deposits totaling greater than $2,999 will earn an additional bonus of 3,000 PC Optimum™ points, for a maximum monthly bonus of 5,000 PC Optimum™ points. Limited to one bonus per customer, per month, even if you have multiple PC Money™ Accounts. The classification of a direct deposit as a payroll or pension direct deposit is determined solely by President’s Choice Bank. Interac e-Transfer® services, electronic funds transfers, and other forms of deposits or transfers to your account do not count towards this bonus. Bonus points will be awarded to your PC Optimum™ account within 2-3 business days of when you meet the minimum direct deposit amount(s).

2Limited to one redemption per day at Esso™ stations. 10 cents off per litre fuel redemption option valid at Esso™ stations across Canada. Car wash redemption option available at participating Esso™ stations with car wash facilities where advertised. Only redeemable at points level specified in a single transaction. 10 cents off per litre valid on actual number of litres fueled, to a maximum of 40 litres per redemption transaction, or a single car wash depending on the redemption option selected. Limit of one redemption per PC Optimum™ account per calendar day at participating Esso™ stations (in accordance with President’s Choice Services Inc.’s official records). A valid PC Optimum™ card, PC Money™ Account card or President's Choice Financial® Mastercard® must be used as part of the payment transaction in order for PC Optimum™ points to be redeemed on fuel or car wash purchases, as applicable. Car wash options available for redemption are subject to availability and do not include coin operated car washes. Car wash codes can only be used at the station where the reward was issued unless otherwise specified in writing at the time of redemption and may be subject to expiration timelines. Redemption not available using manual card number entry, phone number entry, or the Esso and Mobil™ app. For fuel redemption, taxes payable on full purchase price before application of reward. Points are not redeemable for cash or credit. We are not obligated to award or redeem points based on errors or misprints. PC Optimum™ redemption is not available at Mobil™ stations.

3Minimum redemption is 10,000 PC Optimum™ points (worth $10 in rewards) and in increments of 10,000 points thereafter at participating stores where President’s Choice® products are sold. Some redemption restrictions apply; visit pcoptimum.ca for details, participating stores and full loyalty terms and conditions.

4Earn a bonus of 1,000 PC Optimum™ points for each of up to five bill payments of $50 or more to unique payees, per calendar month, made using a valid PC Money™ Account. Bonus points will be awarded to your PC Optimum™ account within 2-3 weeks of a successful bill payment.

5PC Money™ Account: Earn at least 5 PC Optimum™ points per dollar on qualifying purchases with your PC Money™ Account, wherever your card is accepted. Earn 10 PC Optimum™ points (5 regular PC Optimum™ points plus a bonus of 5 PC Optimum™ points) per dollar on qualifying purchases at participating Loblaw banner stores, Shoppers Drug Mart® stores, Joe Fresh® stores, and Esso™ and Mobil™ stations in Canada. Bill payments, electronic funds transfers, account fees and interest are not qualifying purchases for the purpose of earning PC Optimum™ points. PC Optimum™ points will be deducted for any credits or returns. President's Choice Bank reserves the right to cancel, change or extend regular and bonus points earning rates at any time. Account must be in good standing at time of qualifying transaction and awarding of points. PC® Mastercard®: Earn a minimum of 10 PC Optimum™ points per dollar on all of your purchases charged to the credit card. Any bonus PC Optimum™ points offers available to all PC Financial® Mastercard® customers are calculated based on the regular earnings rate of 10 PC Optimum™ points per dollar spent. This offer may be terminated or changed at any time.