6 steps to kick-start your PC Money™ Account right now

You’ve signed up for your PC Money™ Account—an incredibly smart move. Maybe it was the no monthly fee that encouraged you. Or maybe you were mesmerized by all the PC Optimum™ points you can earn on your everyday spending and the banking you’re already doing. It was the points, wasn’t it? Dont have a PC Money™ Account? Apply here (opens in a new window). We get it. But if you’re not using your PC Money™ Account to its full potential, you could be missing out on more opportunities to earn points. So how do you make the most of your PC Money™ Account? It’s easy—just follow these steps:

1. Activate + fund your account.

First things first: see that sticker on your new PC Money™ Account card? It has the details you’ll need to activate your card online—you’ll find all the details here (opens in a new window). The next thing you need to do to start using your card: put funds in your account. There are four ways to fund, so you can choose whichever is easiest for you and your lifestyle.

Fund via payroll/pension direct deposit: Once you set up your payroll or pension direct deposit, you won’t have to think twice about keeping your PC Money™ Account funded. There are some other big advantages to this funding method, too—like earning up to 5,000 points every month—so be sure to keep reading.

Fund via Interac e-Transfer® deposit: A fast and easy way to fund your PC Money™ Account. To make funding your account with Interac e-Transfer® even easier, see how to set up auto deposit to your PC Money™ Account here (opens in a new window).

Fund via a transfer from an external bank account: You can link (opens in a new window) another bank account to your PC Money™ Account for one-time or recurring transfers to make sure your account is funded.

Fund via bill payment : Simply set up your PC Money™ Account as a payee from another bank account—you can even set up regular deposits. It’s easy and keeps your account funded. Here’s how to do it:

1. Log into your other bank and go to the "bill payments" section.

2. Add "PC Financial – PC Money Account" as a payee.

3. Enter your 16-digit PC Money™ Account card number and save it as a new payee.

4. Make a bill payment to add money to your PC Money™ Account.

Follow your bank's instructions to set up regular payments and automate deposits into your account.

2. Link your accounts to maximize your points earning.

If points motivated you to sign up for your PC Money™ Account, then you’re not going to want to miss this step! Linking your PC Optimum™ account with your PC Money™ Account allows you to see all your points in one place and load your personalized offers directly in the PC Financial® app. Here’s how to easily link your accounts (opens in a new window) so you don’t miss out on earning points.

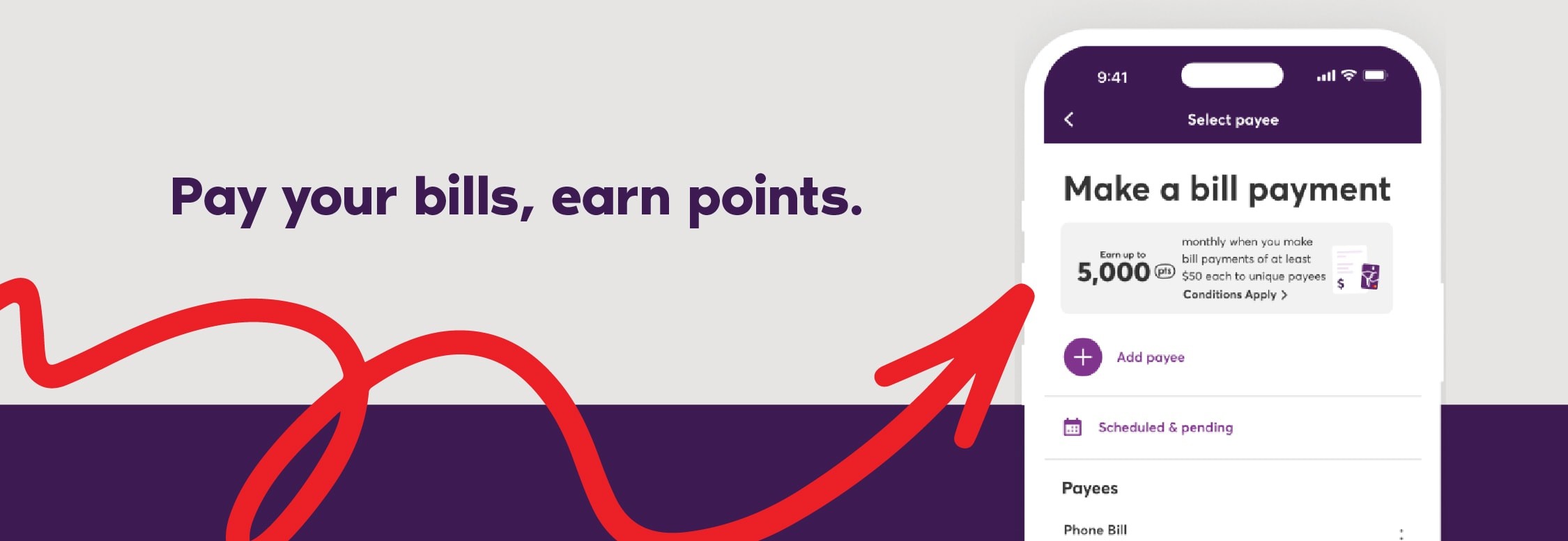

3. Pay your bills, earn points, repeat.

The beauty of the PC Money™ Account is that it rewards you for the everyday banking activities you’re already doing, including paying your bills (opens in a new window) . Paying internet, utilities, and even your PC® Mastercard® bills with your PC Money™ Account is easy. It can also earn you 1,000 points³ for each one, for up to five bill payments a month of $50 or more to unique payees—that’s up to 5,000 points per month! Set up recurring bill payments so you don’t miss a due date—or miss out on points.

4. Set up your payroll or pension direct deposit and, you guessed it, earn points every month.

Not only is it a great way to keep your PC Money™ Account always funded, but it’s a brilliant way to earn points every month with just a onetime setup. Attach your payroll or pension direct deposit to your PC Money™ Account in a few easy steps (opens in a new window) and start earning points for getting paid. Here’s how the points⁴ break down:

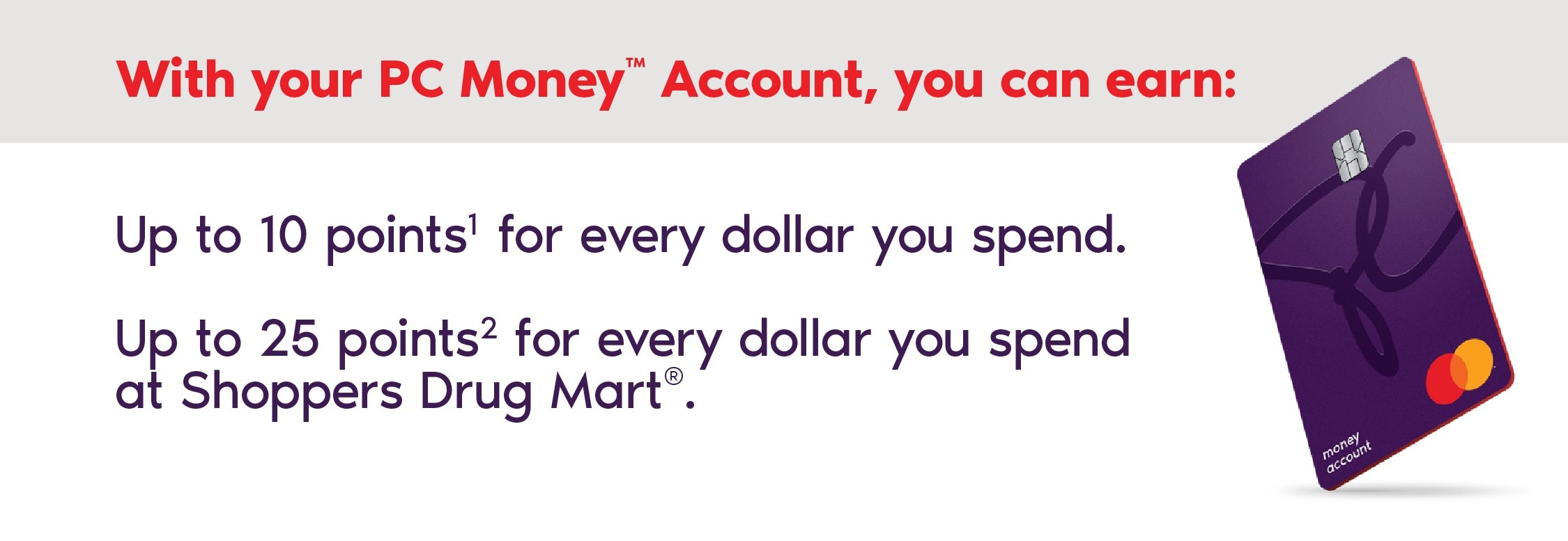

5. Make a purchase, earn points, repeat.

Now that your card is activated, and your account is funded and linked to your PC Optimum™ account—it’s time for the fun part. Start earning points on every dollar you spend with your PC Money™ Account, everywhere you shop. Don’t leave points unearned! Here’s how it breaks down:

6. Set up mobile wallet.

You’ve made it to the last step and it’s a super-easy one: add your PC Money™ Account to your mobile wallet for a speedy checkout and so you can earn points on the go. Get more info on how to do it here.

And with these steps done, you’re ready to start earning points for your everyday banking and spending with your PC Money™ Account. Way to go!

General information not about PC Financial® products is provided for your reference and interest only. The above content is intended only to provide a summary and general overview on matters of interest and is not a substitute for and should not be construed as the advice of an experienced professional. PC Financial® does not guarantee the currency, accuracy, applicability or completeness of this content.

¹Earn at least 5 PC Optimum™ points per dollar on qualifying purchases with your PC Money™ Account, wherever your card is accepted. Earn 10 PC Optimum™ points (5 regular PC Optimum™ points plus a bonus of 5 PC Optimum™ points) per dollar on qualifying purchases at participating Loblaw banner stores, Shoppers Drug Mart® stores, Joe Fresh® stores, and Esso™ and Mobil™ stations in Canada. Bill payments, electronic funds transfers, account fees and interest are not qualifying purchases for the purpose of earning PC Optimum™ points. PC Optimum™ points will be deducted for any credits or returns. President's Choice Bank reserves the right to cancel, change or extend regular and bonus points earning rates at any time. Account must be in good standing at time of qualifying transaction and awarding of points. Minimum redemption is 10,000 PC Optimum™ points (worth $10 in rewards) and in increments of 10,000 points thereafter at participating stores where President’s Choice® products are sold. Some redemption restrictions apply; visit pcoptimum.ca for details, participating stores and full loyalty terms and conditions.

²All PC Optimum™ members earn 15 points per dollar on eligible purchases at Shoppers Drug Mart® and Pharmaprix®. When you use your PC Money™ Account, you will earn an additional 10 points (5 regular PC Optimum™ points plus 5 bonus PC Optimum™ points) per dollar of your purchases.

³Earn a bonus of 1,000 PC Optimum™ points for each of up to five bill payments of $50 or more to unique payees, per calendar month, made using a valid PC Money™ Account. Bonus points will be awarded to your PC Optimum™ account within 2-3 weeks of a successful bill payment.

⁴Earn a monthly bonus of up to 5,000 PC Optimum™ points when you deposit funds to your PC Money™ Account using automatic payroll or pension direct deposits. Payroll or pension deposits totaling between $1,500 and $2,999 within a calendar month will earn a bonus of 2,000 PC Optimum™ points, and deposits totaling greater than $2,999 will earn an additional bonus of 3,000 PC Optimum™ points, for a maximum monthly bonus of 5,000 PC Optimum™ points. Limited to one bonus per customer, per month, even if you have multiple PC Money™ Accounts. The classification of a direct deposit as a payroll or pension direct deposit is determined solely by President’s Choice Bank. Interac e-Transfer® services, electronic funds transfers, and other forms of deposits or transfers to your account do not count towards this bonus. Bonus points will be awarded to your PC Optimum™ account within 2-3 business days of when you meet the minimum direct deposit amount(s).