Secure Your Digital Wallet: 5 Essential Online Banking Habits to Manage Your Finances with Confidence

Key Points

Create strong, unique passwords and never reuse them

Enable Two-Step Verification (2SV) to block unauthorized access

Learn to spot phishing scams; never click suspicious links or share your password

Bank only on secure networks using the official PC Financial® app or website

Monitor your transactions and enable real-time alerts to spot fraud quickly

Managing your finances has never been easier, thanks to the power of online and mobile banking. With just a few taps, you can check your balance from the grocery store, pay a bill from your couch, or track your spending on the go. This convenience gives you incredible control over your financial life. But to ensure that your experience is always safe and positive, it’s helpful to keep a few simple security practices in mind. You can think of them as “habit upgrades”, and the good news is that these habits are easy to build into your routine.

This article walks you through five essential practices that will empower you to bank with confidence, knowing your information is well-protected.

Build a digital fortress with strong passwords

Your password is the first line of defense. A weak or reused password is like leaving your front door unlocked.

Create complexity: Combine uppercase and lowercase letters, numbers, and symbols to create a strong, unique password for your online banking. Avoid using easily guessable information like birthdays or names.

Be unique: Never reuse your banking password for any other online account. If another service is compromised, your financial accounts will remain secure.

Consider a password manager: These tools can generate and securely store complex, unique passwords for all your accounts, so you only have to remember one master password.

At PC Financial®, that single password is the key to your PC Money™ Account, your PC® Mastercard®, and the valuable PC Optimum™ points you’ve earned. That’s why we enforce password complexity requirements as a baseline for your security. Using a unique password for our services is the most important step you can take to keep your rewards and finances separate and secure from other online accounts.

Two-Step Verification adds a powerful second layer of security. Even if someone manages to steal your password, they won't be able to access your account without the second verification step.

How it works: After entering your password, you'll be asked to provide a second piece of information, typically a one-time code sent to your trusted mobile device.

Why it matters: This process confirms that it’s really you signing in, effectively blocking unauthorized access attempts.

PC Financial® uses Two-Step Verification (2SV) as a key security measure when you access your account or perform sensitive transactions. To ensure this works seamlessly, it’s crucial to keep the phone number associated with your account up to date in your profile. This way, you’ll always receive the one-time verification codes needed to secure your account.

Be cautious of fraudulent emails, texts, and phone calls from scammers impersonating bank representatives. These criminals may even fake their caller ID to make it look like the call is from PC Financial®. They will often create a sense of urgency to trick you into giving up control of your account. Think of yourself as a detective. Scammers leave clues and knowing what to look for puts you in control.

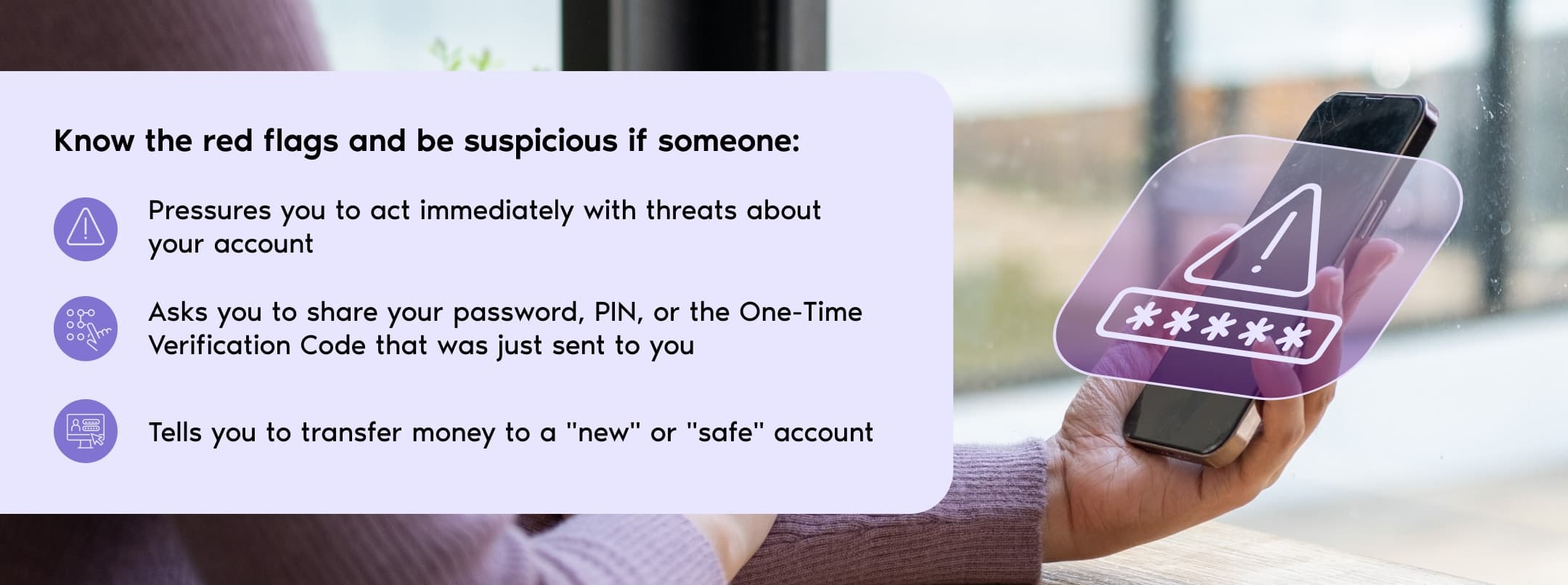

Know the red flags: Be suspicious if anyone contacts you and

Pressures you to act immediately with threats about your account

Asks you to share your password, PIN, or the One-Time Verification Code that was just sent to you

Tells you to transfer money to a "new" or "safe" account

Stop, don't respond, and verify: If you encounter any of these red flags, hang up immediately. Do not click any links or reply to suspicious messages. If you are concerned, verify the situation by contacting us directly using the official phone number on the back of your card or on our website—never use contact information provided by the caller.

For PC Financial customers, remember that we will never ask you to share your password, PIN, or One-Time Verification Code in an email, text, or unsolicited call. The safest way to manage your account is through the official PC Financial® mobile app or by typing pcfinancial.ca directly into your browser.

Where and how you access your accounts matters.

Use secure networks: Avoid using public Wi-Fi (like in cafes or airports) for banking. These networks can be less secure, making it easier for others to intercept your data. Use your cellular data or a trusted, password-protected Wi-Fi network instead.

Look for the lock: Always verify that the website address starts with https:// and that you see a padlock icon in your browser's address bar. This indicates a secure, encrypted connection.

Keep everything updated: Regularly update your device's operating system, your web browser, and the PC Financial mobile app to ensure you have the latest security patches.

The best way to ensure a secure connection to your account is by using the official PC Financial® mobile app, downloaded only from the Apple App Store or Google Play Store. When using a web browser, always double-check that the address is pcfinancial.ca and look for the padlock icon. This guarantees you are connected to our genuine, encrypted site and not a fraudulent look-alike.

Proactive monitoring is one of the best ways to spot unusual activity quickly.

Review transactions: Log in to your account regularly to review your transaction history and statements. Report any transactions you don’t recognize immediately.

Enable account alerts: Set up email or push notifications for specific activities, such as large transactions, ATM withdrawals, or a drop of your account balance below a set amount. These real-time alerts provide immediate awareness of important account activity.

The PC Financial® mobile app is your ideal tool for this. You can enable push notifications for real-time alerts on transactions that exceed a threshold of your choosing for your PC® Mastercard® or PC Money™ Account. Making it a habit to regularly scroll through your recent activity in the app is the quickest way to spot and report any unauthorized charges, protecting your money.

Keeping your finances safe is a partnership, and you're the most important partner we have. Your role is to practice these simple, powerful habits. Our role is to provide a secure platform to support you every step of the way.

As part of that commitment, President’s Choice Bank is a member of the Canada Deposit Insurance Corporation (CDIC), which means your eligible deposits are protected. It’s one more layer of confidence in our shared security commitment.

By working together, we create a robust line of defense that lets you enjoy the full convenience of online banking, along with peace of mind. This allows you to focus on what matters most: managing your money with ease, while rewarding yourself with all the everyday wins PC Financial® has to offer.