How to Save Smarter for Emergency Funds (and Life’s Big Moments)

Key Points

Set a realistic goal, tailored to your situation (income, expenses, timeline etc.)

Open a dedicated savings account as a secure place for your funds

Looking for a hands-off approach? Automate your savings for consistent, regular contributions

Leverage a trusted digital tool to help you track spending and budget effectively

Pro Tip: Choose an account with a high everyday interest rate to maximize your savings growth and no monthly fee eroding your funds over time.

Being financially prepared in a pinch can provide future you with peace of mind during an emergency. But future-proofing your finances doesn’t just help you out down the road. It can also instill confidence during your most stable times, knowing you’re prepared for any financial emergency, from a busted appliance to an unexpected job loss.

If setting aside a large sum of money feels daunting, that’s fair! But it’s actually accessible when you have simple steps in place and take advantage of opportunities to accelerate your savings.

It may be helpful to think of building your emergency fund as a balancing act—you want to be responsible now, so you don’t look back regretting that you didn’t save more, but also give yourself room to live a little and enjoy the money you work hard for.

So, what does preparation look like? Great question!

Planning for unexpected situations

Nobody wants to be caught off guard financially, especially if you’ve got other people who rely on you.

And while we can’t control or predict every event in life, we can plan for the unexpected.

Having access to dedicated savings doesn’t just help you out of a tight spot, it can also help prevent you from making regrettable financial decisions, like taking on additional credit card debt or high-interest loans. These choices can help you in the short term but cost you in the long term.

The type of account you choose also matters. An emergency fund needs to be stable, consistently growing with a high everyday interest rate (so you’re not doing all the work to reach your savings goal faster), and most importantly, accessible when you need it.

Step-by-step guide on how to build your emergency fund

Step 1: Identify your savings goal

There isn’t a one-size-fits-all approach to building an emergency fund. But that doesn’t mean you can’t set a goal that makes sense for you.

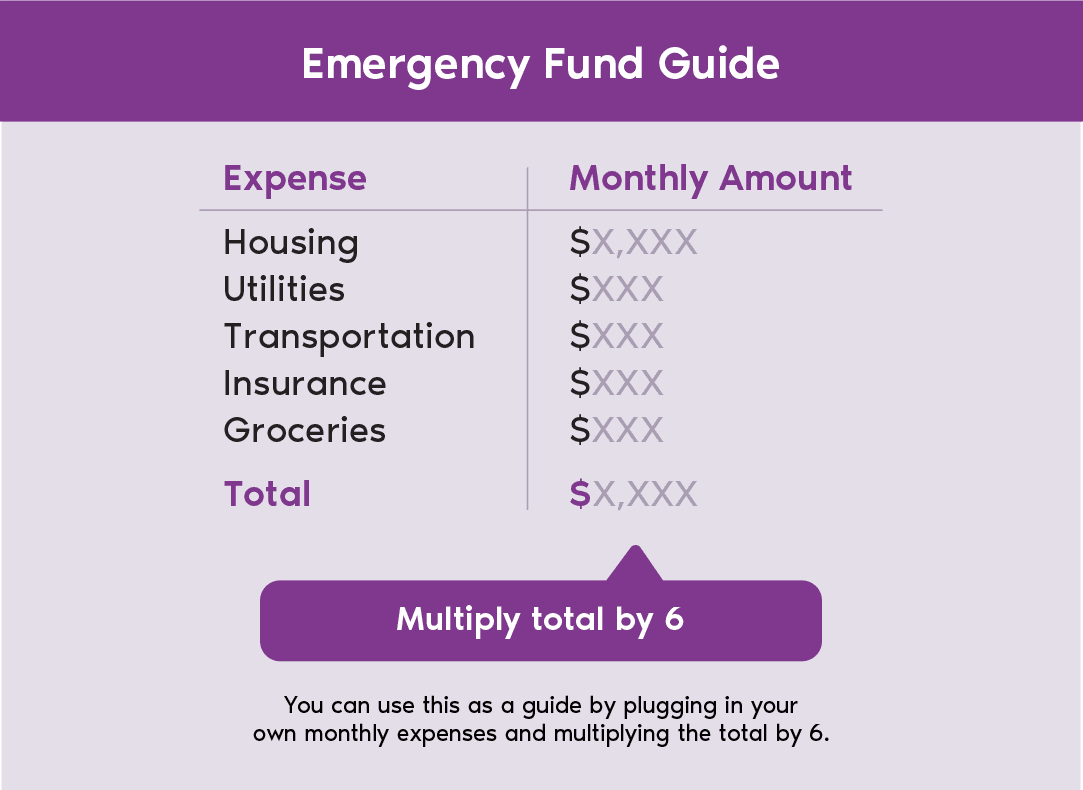

The general rule of thumb is to have enough set aside to cover at least 3 months of non-negotiable essential living expenses (we recommend striving for 6 to have additional peace of mind). That could include your rent or mortgage payments, vital utilities (like electricity and water), monthly insurance/service bills, groceries, and transportation. For example, if you were to lose your job, 3-6 months gives you breathing room so that your budget is one thing you don’t have to worry about while getting back on your feet.

Step 2: Determine how much you should be contributing on a monthly basis

Setting money aside isn’t always easy, but taking it step by step makes it more manageable and less intimidating. And do yourself a favour, keep the amount and timeline realistic (opens in a new window). It may help to think of this as a project you chip away at, rather than a scramble to catch up.

Start by looking at how much you earn.

Determine the total amount your household regularly brings home each month after all deductions (like taxes, pensions, and benefits).

List and tally all your recurring, non-negotiable monthly costs (like housing payments, utilities, transportation, and groceries).

Now subtract your total monthly expenses from your net monthly income. The remaining amount is your discretionary income, which you can use for spending, saving, or investing.

As a general rule of thumb, you’re going to want to put aside at least 5% of your monthly income, but committing to 10%, if comfortable, can make a substantial difference on your savings journey.

Don’t forget to leave a realistic amount each month for discretionary spending on things like entertainment, clothing, or other items on your wish list, ensuring it aligns with your overall savings goals.

Pro Tip: You can expedite this timeline with a competitive high interest rate to help your money grow faster! Keep reading for more on this.

Step 3: Separate saving from spending

Keep your emergency fund easily accessible and clearly designated for savings. This helps prevent frivolous spending and ensures your funds are ready when an emergency strikes. Consider an account that allows you to allocate specific funds for savings, offering both growth and immediate access.

Pro Tip: The next time you receive a raise, tax refund, or bonus, you can top up your fund more quickly without stretching your regular budget.

Preparing for life’s big moments

It’s not just emergencies that require some financial foresight.

Whether it’s a vacation or picking out the perfect engagement ring, life moments shouldn’t be derailed by lack of preparation.

Just like planning out and pulling off your emergency fund, you should consider what these costs may look like and the saving timeline you’ll require. And if you’re saving for multiple things at once, you may need to adjust your budget and timelines.

Pro Tip: The PC Money™ Account provided by PC Financial® offers an optional savings feature that lets you keep your spending balance and savings funds separate. Compartmentalizing your funds this way can help you track your progress toward your savings goal and deter you from inadvertently dipping into your savings.

Pssst… keep an eye out for a future blog that digs deeper into saving for the moments you’ll cherish forever!

Using an everyday savings rate as a tool for accelerated growth

If putting your savings aside is a “step” in the right direction, putting it in a high everyday interest savings account is a “leap”!

If you read our How to Calculate Interest on your Savings (opens in a new window) article, then you already know that a consistently competitive, everyday rate can help you reach your goals faster through compound interest. This is particularly beneficial because, unlike temporary promotional rates that often expire after a short period, an everyday rate provides stable and reliable growth for your long-term savings.

Utilize digital tools

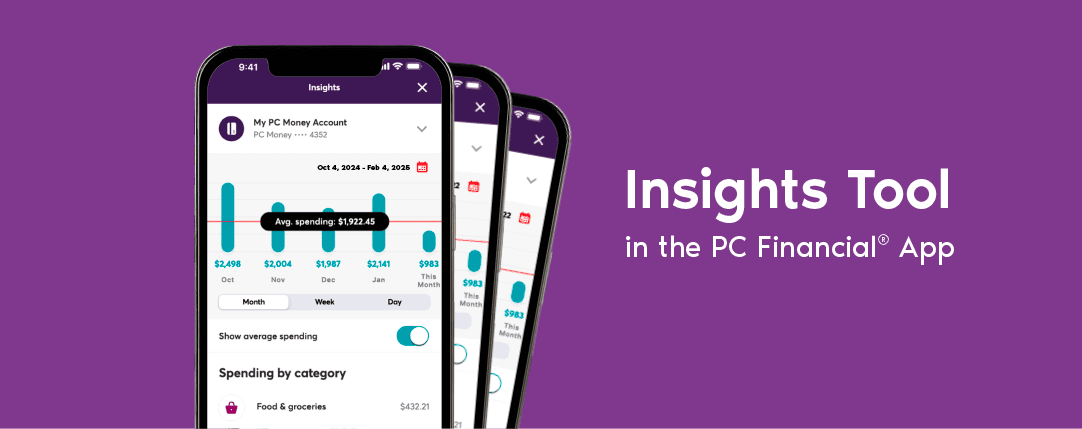

Building a robust savings fund isn't just about putting money aside; it's also about managing what you spend so you have more to save.That’s why it's important to track your spending (opens in a new window) as you build your emergency fund—but you don’t have to do it on your own. There’s plenty of digital tools you can lean on, like the Insights Tool in the PC Financial® app. It’s a financial dashboard that can help you understand your spending habits and make smarter budgeting decisions—without any complicated financial jargon.

By turning your transaction data into clear visuals and practical info, it can help you build a budget that reflects your real life (and makes sticking to it easier).

Having all this information in one place can be a gamechanger, helping you adjust your habits to keep more money in your pocket and reach your goals faster!

Ready to start future-proofing your finances? Open a PC Money™ Account today.

Taking the first step forward is easy. Sign up today and join thousands of customers earning over $700 in value every year†.

We’re not like other banks

Earn 2.7% high everyday interest2 on your savings, with no catches and no promo period, so you can grow your savings faster!

No monthly fee1 eating away at your hard-earned money

No minimum balance because everyone deserves our best everyday rate.

No time commitment so you can access your money when you need it (kind of the whole point, right?).

Ready to get started (opens in a new window)?

General information not about PC Financial® products is provided for your reference and interest only. The above content is intended only to provide a summary and general overview on matters of interest and is not a substitute for and should not be construed as the advice of an experienced professional. PC Financial® does not guarantee the currency, accuracy, applicability, or completeness of this content.

*PC Express™ Pass is a monthly or annual subscription plan that gives you $0 pickup or delivery on same-day or future PC Express™ online grocery orders of $30 or more for the duration of the plan. Annual subscription fee of $99.99, plus applicable taxes is waived for PC Insiders™ World Elite Mastercard® cardholders. Cannot be combined with any other PC Express™ Pass subscription promotional offer. Priority pickup and delivery are available with a PC Express™ Pass for $3. PC Express™ Rapid Delivery is available with a PC Express™ Pass for $3. PC Express™ online grocery orders require a $30 minimum spend (before taxes and fees) in order to receive free same-day or future pickup or delivery. Subscription may be automatically cancelled, and your benefits will end immediately if at any time your PC Insiders™ World Elite Mastercard® account is not in good standing, restricted, closed, or changed to a different President’s Choice Financial® credit card. Visit https://www.pcexpress.ca/pass (opens in a new window) for details on the program.

1Earn a minimum of 10 PC Optimum™ points per dollar on all of your purchases charged to the credit card. Any bonus PC Optimum™ points offers available to all PC Financial® Mastercard® customers are calculated based on the regular earnings rate of 10 PC Optimum™ points per dollar spent. This offer may be terminated or changed at any time.

2Our grocery stores means affiliated Loblaw banner grocery stores. Visit pcoptimum.ca (opens in a new window) for details on participating stores where the PC Optimum™ program is offered. Minimum redemption is 10,000 PC Optimum™ points (worth $10 in free rewards) and in increments of 10,000 PC Optimum™ points thereafter, at participating stores. You can redeem the PC Optimum™ points you earn for eligible purchases, or for any other purposes of which we may advise you from time to time. Some redemption restrictions apply. Visit pcoptimum.ca (opens in a new window) for details, participating stores and full loyalty terms and conditions.

3Statement credit redemptions are available to primary cardholders of an eligible PC® Mastercard® account ("Account") and holders of an eligible PC Optimum™ account, both of which must be open and in good standing at the time of redemption. With this offer, you may redeem PC Optimum™ points using your PC Financial® online account for a statement credit applied against the current balance on your Account. Statement credits are not applied against a specific purchase or other transaction. PC Optimum™ points may be redeemed solely in the increments set out in your PC Financial® online account and for redemption value up to the current balance of your Account, or an amount equal to 500,000 PC Optimum™ points, whichever is lower. The applicable redemption rate will be specified in your PC Financial® online account at the time of redemption. You acknowledge and understand that the PC Optimum™ points redemption rate applicable to this offer may vary from the redemption rate available for other redemption types or offers. For other redemption rates, please refer to your PC Optimum™ Program Terms & Conditions at the URL noted below, or the terms of the specific redemption offer. Once a redemption has been authorized pursuant to this offer, it cannot be changed, cancelled or reversed. Redemption credits from this offer will lower your Account balance, but a redemption is not considered to be a payment on your Account, and you will remain responsible for making a payment of the minimum payment amount specified on your statement by the due date indicated, even if your redemption has reduced your Account balance below your minimum payment amount (including reducing your Account balance to $0.00). Credits may take up to 3 business days to post to the Account. This offer is non-transferable, may not be combined with any other offer, and is subject to change or cancellation without notice to you. This offer and all redemptions pursuant to it are subject to the PC Optimum™ Program Terms & Conditions available online at www.pcoptimum.ca/company-policy/terms-and-conditions.

4Statement credit redemptions are available to primary cardholders of an eligible PC® Mastercard® account ("Account") and holders of an eligible PC Optimum™ account, both of which must be open and in good standing at the time of redemption. With this offer, you may redeem PC Optimum™ points using your PC Financial® online account for a statement credit applied against the current balance on your Account. Statement credits are not applied against a specific purchase or other transaction. PC Optimum™ points may be redeemed solely in the increments set out in your PC Financial® online account and for redemption value up to the current balance of your Account, or an amount equal to 500,000 PC Optimum™ points, whichever is lower. The applicable redemption rate will be specified in your PC Financial® online account at the time of redemption. You acknowledge and understand that the PC Optimum™ points redemption rate applicable to this offer may vary from the redemption rate available for other redemption types or offers. For other redemption rates, please refer to your PC Optimum™ Program Terms & Conditions at the URL noted below, or the terms of the specific redemption offer. Once a redemption has been authorized pursuant to this offer, it cannot be changed, cancelled or reversed. Redemption credits from this offer will lower your Account balance, but a redemption is not considered to be a payment on your Account, and you will remain responsible for making a payment of the minimum payment amount specified on your statement by the due date indicated, even if your redemption has reduced your Account balance below your minimum payment amount (including reducing your Account balance to $0.00). Credits may take up to 3 business days to post to the Account. This offer is non-transferable, may not be combined with any other offer, and is subject to change or cancellation without notice to you. This offer and all redemptions pursuant to it are subject to the PC Optimum™ Program Terms & Conditions available online at www.pcoptimum.ca/company-policy/terms-and-conditions.